Bank Norwegian Credit Card

Bank Norwegian actively markets its Visa credit card in many ways. It is more than just a payment method; the card includes many useful benefits, some of which are even fee-free. Many travellers favour the Bank Norwegian card for its extras. For us, the card enables cheaper and safer travel thanks to its rewards program and insurance.

Read our article on student credit cards.

Online Bank From Norway

As the name suggests, Bank Norwegian is a Norwegian bank. Its headquarters are in Fornebu, but the bank offers services in almost all Nordic countries. Bank Norwegian is owned by the Swedish Nordax Bank AB. It is important to note that the bank and the airline with a similar name are separate companies, although the airline previously held a small stake in the bank.

Bank Norwegian has no traditional branches; it is a pure online bank. Customer service is partly available in Finnish, but outside office hours, help is often only in English and other Nordic languages.

In addition to credit cards, Bank Norwegian grants consumer loans and offers competitive savings accounts.

Visa Credit Card

The credit card issued by Bank Norwegian is a Visa. You can pay for purchases on credit and settle the bill later. You get an average of 45 days of interest-free grace period to pay the bill. If you pay the full balance by the due date, there are no extra fees or interest. Paying only part of the bill moves the unpaid balance to the credit balance, which then incurs expensive interest.

The card also has no annual fee. You can choose the credit limit, but the maximum depends on the applicant. It can be as high as €15,000, though it is usually a few thousand euros. There are no billing fees if you receive the bill by email or as an e-invoice in your everyday bank.

Contactless Payments

Bank Norwegian Visa is a chip card that, like others, supports contactless payments. The card also supports mobile payments via Google Pay, Apple Pay, and Garmin Pay. The most recommended option is to use the new Curve Pay, which eliminates currency conversion fees.

Card Security

The Bank Norwegian Visa card offers a high level of security. Online purchases are usually confirmed with a one-time PIN sent by SMS during checkout and with a personal password. Confirmation is also possible through Bank Norwegian’s own app. The bank automatically monitors card activity and will block the card if it suspects the details have been compromised. Unfortunately, you cannot restrict the card’s geographic usage; it is valid worldwide, even if you would prefer to use it only in Europe.

Read more about online payment security.

You can block the Bank Norwegian Visa card via the mobile app if needed. The feature is a bit tucked away in the app, but you can find it with a little effort. It is also a plus that you can choose your own PIN. If you forget it, you can easily check it in the app. Ordering a replacement card for a lost card is free.

Bank Norwegian Visa Card Benefits

Travel Insurance

The card includes free travel insurance issued by Tryg. The insurance is valid provided that at least 50 per cent of the travel costs are paid with the card. While the card’s insurance itself is sufficient for a trip, we considered it a supplementary travel insurance. The coverage limits are slightly lower than those of standalone policies and include deductibles. It is wise to have real travel insurance alongside it and use the credit card’s insurance as a complement.

Read our guide to travel insurance.

Free Cash Withdrawals

One of the card’s best perks is free cash withdrawals around the world. Bank Norwegian does not charge for withdrawals unless the ATM itself does. If you withdraw in a currency other than euros, the exchange rate is Visa’s mid-market rate, plus a 2.49% currency conversion fee. This FX markup has increased over the years and is now among the highest in the market. You can check the current exchange rate in the Bank Norwegian app..

Abroad, look for an ATM that does not charge a usage fee. For example, avoid expensive Euronet ATMs. Always use the local currency for withdrawals and purchases to secure a favourable exchange rate.

Cashpoints, Cashback, and Spenn

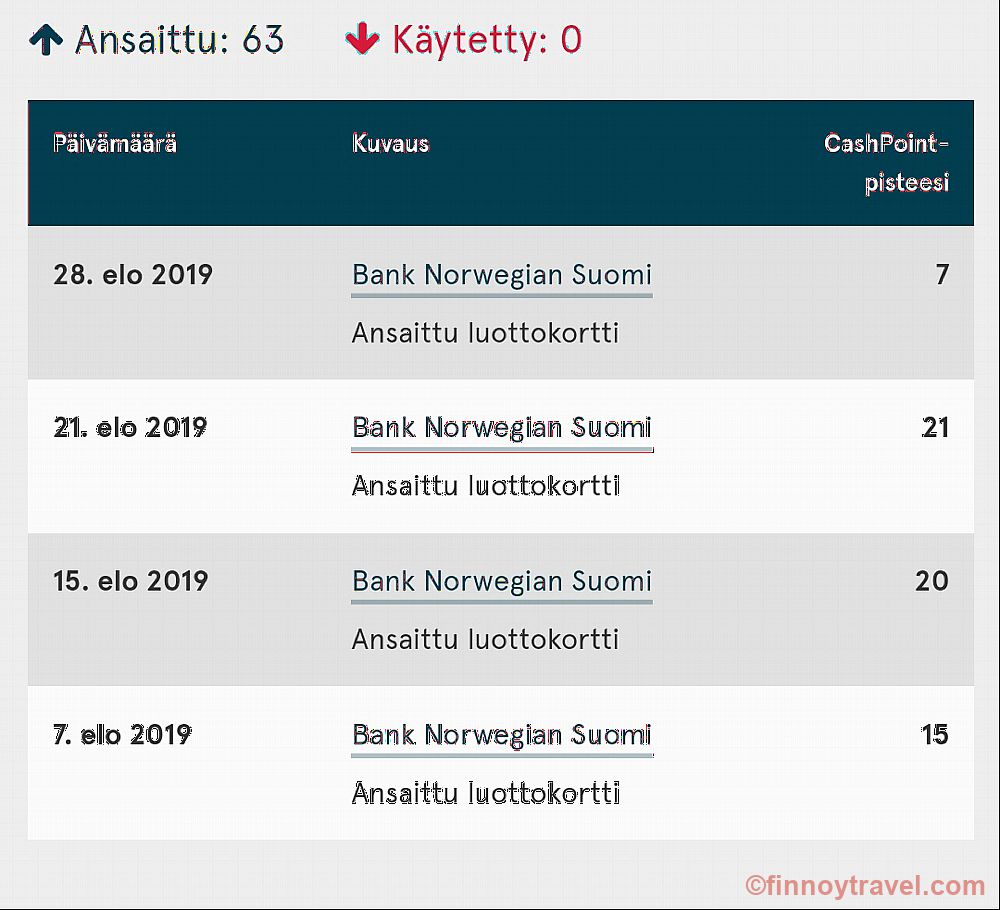

In our view, the best perk of the Bank Norwegian Visa card is its rewards program. Unfortunately, the program has become confusing in recent years, as there are now three reward currencies. You can earn Cashpoints, Cashback, or Spenn, but not all at once.

Traditional reward points, i.e., Cashpoints, can be used to pay for Norwegian airline flights. Cashpoints from several different Bank Norwegian credit cards can be combined into Norwegian’s family account, making them easier to use together.

- You earn 0.5 per cent of the value of purchases made with the card, but not from money transfers, ATM withdrawals, or flights on airlines other than Norwegian Air.

- On Norwegian Air tickets, you earn 3 - 5 per cent in Cashpoints depending on the fare type.

- You can earn Cashpoints on purchases up to a maximum of €15,000 per year.

In our estimate, a family could earn €50 - €150 in rewards per year depending on spending habits. We recommend assessing your spending and estimating potential rewards.

Last year, the Norwegian airline launched a new Spenn rewards program. Travellers can choose to earn Spenn from Norwegian flights instead of cash points. However, you still earn Cashpoints on other Visa purchases made with the Bank Norwegian card. As a result, you may accidentally collect two different reward currencies at the same time, which currently cannot be combined. If you collect Cashpoints with the Visa card, choose Cashpoints instead of Spenn when buying flights too.

Cashback is an alternative way to earn rewards from Bank Norwegian Visa purchases. The rate is also 0.5 per cent, and you get rewards from almost all purchases. You can use the rewards to pay future card bills.

You cannot collect Cashback and Cashpoints at the same time. If you do not plan to fly Norwegian, collecting Cashback is usually the better option.

Bank Norwegian Credit Card Drawbacks

Expensive When You Carry a Balance

No bank can be too generous since banks aim to make a profit. Bank Norwegian makes money from high interest on credit. If you do not pay the bill by the due date and it accrues interest, you must pay the interest until the payment date. Aim to pay your bill in full by the due date to avoid late fees. The card is more valuable when you do not use its interest-bearing credit.

No Lounge Benefit

Bank Norwegian Visa does not include a lounge benefit, which many travellers want. This perk is typical of premium credit cards, but not of free cards.

We recommend reading our article on Helsinki Airport lounges to find affordable ways to visit the lounges at Helsinki Airport.

Our Experiences With the Bank Norwegian Credit Card

We used the Bank Norwegian credit card for years. The card was truly cost-free for us. There was no annual fee, and we always paid the bill on time. As a result, we did not incur interest or other extra costs.

At the customer’s request, the e-invoice total can be set to the full outstanding balance, allowing you to automate full payment in your online bank. This helps prevent accidental extra costs.

As benefits, we received hundreds of euros toward Norwegian flight tickets. In addition, the card’s free travel insurance was in effect as a supplementary policy, even though we primarily used a separate paid travel insurance policy.

Mobile App

Bank Norwegian offers a functional mobile app that lets you adjust card settings and track transactions in real time. The app was initially buggy, but it became stable later. The quality of the Finnish translation also improved.

Through the app, you can view card transactions and adjust the credit limit. You can also pay the bill and get a breakdown of your spending categories.

In the mobile app, you can also track a possible Bank Norwegian savings account or take a consumer loan. You can buy paid supplementary insurance through the app, such as coverage for a rental car deductible. We were mostly satisfied with the app’s quality.

Card Application Process

You apply for the card online and receive an instant decision. If approved, the card is mailed home. Approval criteria may be a bit stricter than at your everyday bank, but getting the card should not be particularly difficult if you are employed and have a clean credit history.

According to Bank Norwegian, the card is available to anyone at least 18 years old with no payment defaults. The applicant must have lived in Finland for at least 36 months before applying. However, each application is assessed individually.

Our Rating of the Bank Norwegian Visa Card

The Bank Norwegian credit card is an excellent payment method, even if not perfect. Because the card has no monthly fee yet still offers significant benefits, we rate it a 5-star credit card. It provided us with clear monetary benefits, especially when travelling. When used correctly, the card does not generate extra costs. On the downside, benefits have worsened slightly over time, and service fees have increased.

Questions and Answers

- What is the monthly fee for the Bank Norwegian Visa card?

- The card has no monthly fee.

- What is the interest rate on the Bank Norwegian Visa credit?

- The interest rate varies, but it is higher than that of many other credit cards.

- From which purchases can you earn bonus points, i.e., Cashpoints?

- You earn 0.5 per cent in bonus points, i.e., Cashpoints, from almost all purchases.

- What can Cashpoints be used for?

- Cashpoints can only be used to redeem Norwegian Air flights.

- What is the value of one Cashpoints point?

- One point is worth 1 Norwegian krone (€0.09).

- What is Cashback?

- Instead of Cashpoints, the cardholder can collect Cashback at 0.5%. You can use this reward to pay future bills.

Bottom Line

We considered the Bank Norwegian credit card a must-have for every traveller. Used correctly, it is free yet delivers financial benefits. Use the card carefully to avoid incurring unnecessary interest charges.

The credit card and its features work well. The included mobile app made tracking purchases significantly easier. If the card was lost or otherwise needed to be replaced, a new card was provided at no cost.

Despite the good features, we recommend carrying a card from your everyday bank alongside the Bank Norwegian credit card. On trips, it is wise to have at least two credit cards with you.