This article may contain affiliate links to commercial services.

Is Curve a Credit Card?

Curve Mastercard is not a credit card; it is a debit card that offers cashback and other features. You can’t pay with the Curve card alone; you need at least one real credit or debit card linked to it. Curve is a payment card that forwards transactions to another card you choose. For example, with Curve paired with the Bank Norwegian Credit Card, you pay with Curve, and it charges your Norwegian credit card in real time.

Because Curve is not a traditional credit card, any adult living in Finland will likely get it by applying. The company behind the card is based in London, but Curve is marketed across the European Economic Area and, to a limited extent, in the United States. Curve’s Lithuanian subsidiary issues cards delivered to Finland. Curve offers both a physical card with a PIN and contactless payment, as well as a virtual card. You manage both via the mobile app. The cards also support Apple Pay, Google Pay, and Samsung Pay. As a result, you can start using the virtual card before the physical card arrives. Curve doesn’t have a true like-for-like competitor; for example, the popular Revolut Card and Curve complement each other when used together.

What Value Does Curve Add?

Many wonder what value a card adds if it only forwards the payment to another card. The forwarding itself doesn’t create value; the benefits come from Curve’s other features. We have used Curve for years and, based on that experience, we explain Curve’s advantages.

You can set the currency per linked card from several options. Transactions are forwarded in that currency. In Finland, it naturally makes sense to set cards to euros, as we have done.

Read Revolut Card Review.

Curve Card Benefits

Managing Multiple Cards With the Curve App

If you carry several payment cards, Curve is a great tool. You can pay for everything with Curve and then choose in the app which linked card will be charged. You can even change the card retroactively for 30 - 120 days using the Go Back in Time feature.

This is especially useful if you have personal cards, work cards, and perhaps a shared card with a partner. You can always pay with Curve and, in the app, choose either before or after to allocate the expense to a specific card. The cards you want to use with Curve must be added to the app before you can charge them. These can be Visa, Mastercard, Diners Club, or the less familiar Discover cards in Finland.

Unfortunately, many supermarket loyalty cards remain a challenge. While the Curve card alone is enough to pay for purchases, many store loyalty cards are still physical. We believe these will gradually move to digital formats, like the Lidl Plus card.

Credit Payments With a Debit Card

Curve itself is a debit card, but it can forward payments to a credit card. This makes it possible to run a credit transaction even at merchants that wouldn’t normally accept credit. The feature is called Curve Frontend.

The feature is fee-free primarily, but Curve charges a 1,5% service fee if, for example, you pay tax-like charges with Curve. On paid Curve tiers, even this is fee-free up to a specific limit.

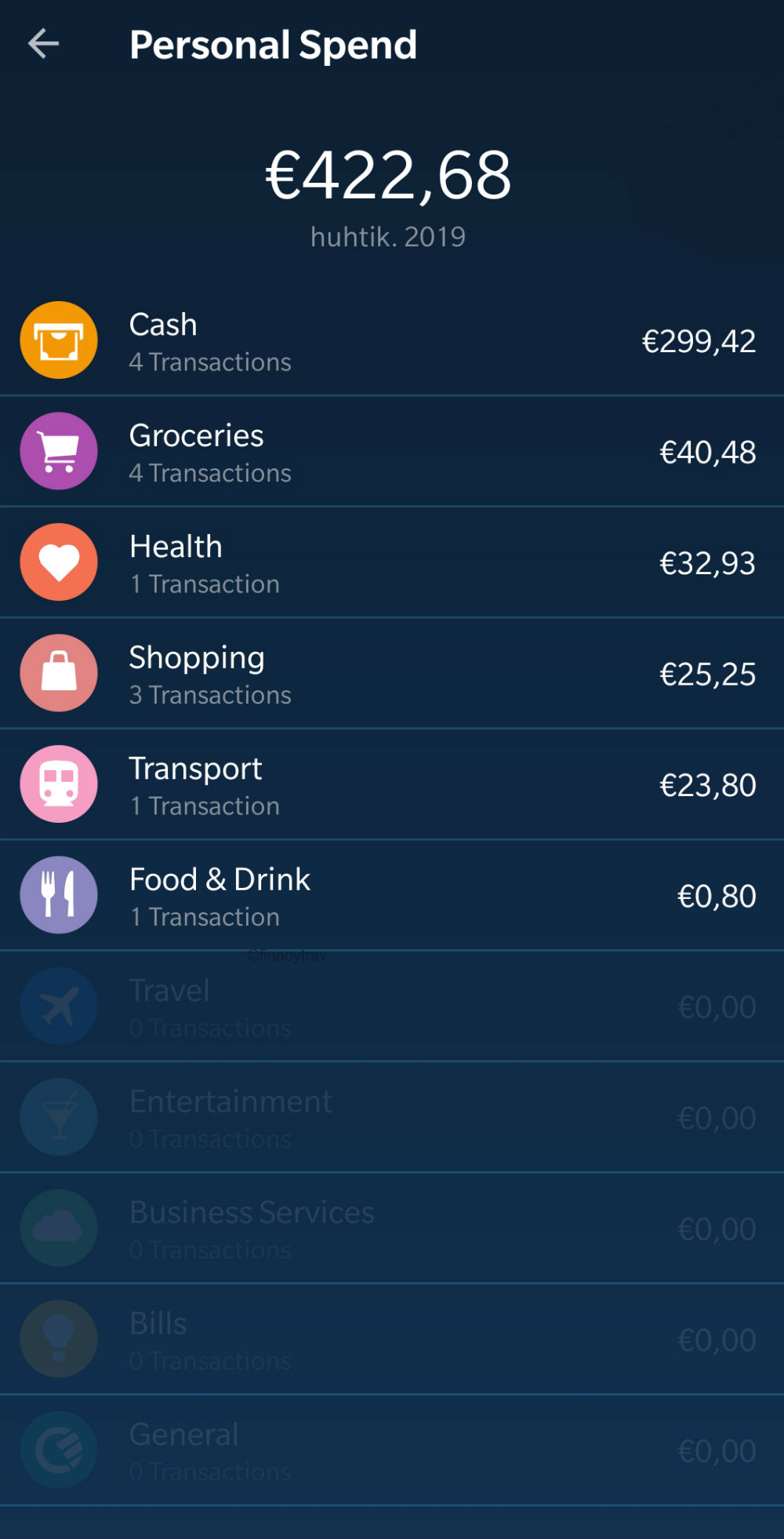

Spending Analytics

The Curve app gives clear statistics on where your money goes. You can see by category how much you’ve spent on, for example, travel or groceries. When you purchase with Curve, the merchant provides category information that Curve uses to build your spending stats.

Low-Cost Currency Conversion

Curve’s currency conversion is very inexpensive with minor exceptions. With regular bank cards, purchases in non-home currencies are converted to euros using the bank’s exchange rates, and banks often add a margin of more than 2 per cent. Curve converts without an extra margin using Mastercard exchange rates, which are close to interbank mid-market rates.

If you live in Finland, choose the euro as your card currency. Then, when you pay in a foreign currency, Curve converts the amount to euros at the current Mastercard exchange rate and forwards the transaction to your chosen card in euros.

We made purchases with Curve in Croatia, Turkey, and Israel. On holiday, you can easily save 1-2% of your daily budget because currency conversions are cheaper. This applies only to trips outside the euro area.

Curve cards have usage limits: there are caps for overall card use and ATM withdrawals, and there’s an upper limit for fee-free currency conversion. Some limits may increase as Curve gets to know you. Higher, paid Curve tiers have higher limits. In addition to Curve’s limits, the limits of your linked underlying cards still apply.

When using rare currencies, an extra fee may apply. We recommend reading Curve’s price list.

Cashback on International Spend

On paid Curve tiers, you can earn a 1 per cent bonus on purchases outside Europe and the UK. For example, you get 1 per cent back on purchases paid in US dollars. In addition, currency conversion fees are very low, so that the total savings may be over 3 per cent compared to a typical payment card .

Fee-Free Cash Withdrawals From ATMs

With paid versions of Curve, you can withdraw a small amount of cash from ATMs fee-free each month. The exact amount depends on the tier.

There is a catch, though. While Curve doesn’t charge for withdrawals, many ATMs do. You’ll need to find an ATM that doesn’t charge a fee. In our experience, you can find one fairly quickly almost anywhere.

Because Curve forwards both the transaction and its type to your selected card, the issuer of the underlying card may charge a cash withdrawal fee. When using an ATM with Curve, it’s important to route the withdrawal to a card that doesn’t charge ATM fees. A good choice is, for example, the Bank Norwegian Credit Card, which doesn’t charge for ATM use.

Use Curve for ATM withdrawals when you’re withdrawing in a currency other than euros. That way, you save on conversion fees.

Anti-Embarrassment Mode

Many have had that awkward moment at checkout when there wasn’t enough balance on the card. You could solve it by paying in cash or with another card—if you have one with you.

Curve automates this. If the card currently selected in the Curve app doesn’t have enough funds, Curve automatically tries the same charge on one or more of your other cards. As soon as a card with sufficient funds is found, the transaction is approved as usual. The app notifies you when Anti-Embarrassment activates so you can reorganise your cards afterwards.

Security Features

Like many credit cards, Curve also offers security features. For example, while travelling in Krakow, we had an issue paying at a restaurant. We asked the waiter twice to charge us in Polish zloty, but the bill was still in British pounds. Because Curve sends real-time payment notifications to the phone, we immediately noticed the error. We asked the waiter to fix it, but he said it couldn’t be done. We contacted Curve customer support and received a positive response shortly thereafter.

...Thanks for sending this through.

The dispute process is quite lengthy and not always successful. Given the value of the transaction, we would like to issue a refund as a gesture of goodwill.

We can see that without the merchant's exchange rate, the 110 PLN would be 23.08 GBP. We would, therefore, like to refund you 1.85 GBP directly...

The quick, friendly reply convinced us that Curve cares about its customers.

Large online purchases must be verified with a PIN code sent by text message or via the Curve app. Authentication is clearly easier and faster than, for example, using Nordea’s code app.

Smart Rule Payment Rules

With Smart Rule payment rules, you can predefine how charges are routed to different cards. For example, you can route grocery purchases to a Nordea card and travel expenses to Bank Norwegian Visa. You set conditions for each rule; when they’re met, the transaction is forwarded to the card the rule specifies.

LoungeKey Membership

The top Curve Pay Pro+ tier includes LoungeKey membership. Membership gives discounted lounge visits at airports such as Helsinki Airport’s gate 27 Aspire Lounge, gate 13 Aspire Lounge, and the Plaza Premium Lounge. If you fly several times a year, the perk is worth the price.

Explore Student Credit Cards.

Curve Card Tiers

Curve Pay

Most of the features above are included in the free Curve Pay card, but with low usage limits. The base card has no monthly fee, but delivery costs 5,99 euros.

You can link only three payment cards to the no-monthly-fee Curve. Its limits are low, and you can set only two Smart Rules. Fee-free ATM withdrawals aren’t available.

Curve Pay X

Curve Pay X is a slightly better version of the base card. Delivery is free, but the monthly fee is 5,99 euros. Curve Pay X supports five payment cards, offers somewhat higher limits, and allows more Smart Rules. You can make fee-free ATM withdrawals up to 300 euros per month. The card has the same features as Curve Pay and, among others, the following extra feature:

- You earn an extra 1 per cent bonus on purchases outside Europe and the UK.

Curve Pay Pro

Curve has two premium versions, the cheaper being Curve Pay Pro. There’s no acquisition cost, but the monthly fee is 9,99 euros. The card has the same features as Curve Pay X plus a few extras:

- You can make fee-free ATM withdrawals up to 500 euros per month.

- You earn a 1 per cent bonus from 6 merchants of your choice.

- The Curve Fronted feature is free up to a certain limit.

Curve Pay Pro+

Curve Pay Pro+ is Curve’s best version. It costs 17,99 euros per month.

Curve Pay Pro offers a few extra perks:

- The physical card is metal.

- Usage limits are higher than other cards.

- You earn a 1 per cent bonus from 12 merchants of your choice.

- You get discounted access to LoungeKey airport lounges.

Cashback Card

Curve is not a typical cashback credit card, as it doesn’t offer credit. However, it does include a cashback feature called Curve Cash.

Curve Pay Pro and Curve Pay Pro+ give a 1 per cent purchase bonus at merchants you select. Curve Pay Pro users can choose six merchants, and Curve Pay Pro+ users can choose 12. The list includes Lidl, Shell, Amazon, Booking.com, and many others. Curve pays the bonus, so you also earn any rewards from your linked cards, such as Bank Norwegian’s own cashback.

Using Curve Cash

Curve Cash accrues in the Curve app in British pounds. You can use this money like any other underlying card with Curve. However, you can only pay with Curve Cash if your balance covers the full purchase amount.

You can also use Curve Cash automatically by turning on the feature in the app. If enabled, purchases are paid with Curve Cash whenever the balance is sufficient. Otherwise, the charge goes to your selected payment card as usual.

Curve’s SecurityFeatures

The Curve card includes multiple security features. All transactions appear in real time in the Curve app. You can temporarily lock the card in the app and unlock it just as easily. Tracking your spending with Curve is easy.

Online purchases follow EU Requirements for customer authentication.

Curve Customer Protection

Curve Customer Protection protects you from failed and fraudulent transactions. Fraudulent or unauthorised charges are refunded. You can also request a refund if you didn’t receive the product or if it has quality issues. The terms of this protection are complex; read them carefully on Curve’s website.

As an example, consider an airline bankruptcy. If you bought and paid for the tickets but never flew due to the bankruptcy, Curve will refund the payment.

Our Experiences With the Curve Card

Many new Curve users wonder which cards to link to Curve. The optimal combination depends on which payment cards you already have, and our setup may not suit everyone.

We paid almost all of our purchases with Curve, so we’ve gathered years of experience with the card. We linked, among others, the Bank Norwegian Visa and Nordea’s debit/credit Mastercard to Curve. Bank Norwegian Visa is an excellent choice because we get a 0.5 per cent bonus on all purchases, which we can redeem for Norwegian Air Shuttle flights. Bank Norwegian also doesn’t charge for ATM withdrawals and doesn't have a monthly fee. Nordea’s Mastercard doesn’t offer similar perks, but since Nordea is our main bank, it was a good alternative payment card.

Fair Use Policy

There are no predefined limits for every Curve feature, but you must still use the card reasonably. Certain features, such as ATM withdrawals, cost Curve money per transaction. If you use these features frequently, Curve incurs unreasonably high costs and has the right to close the card.

We have used Curve’s features in many ways and never had any issues because of it.

Questions and Answers

- How does a payment made with Curve appear on the linked card’s statement?

- When Curve forwards a payment to another card, the original merchant name appears in the statement, but it also shows that the transaction came via Curve (e.g. CRV*KFP MYYRMAKI OY -9.90). We often use the Bank Norwegian credit card with Curve and have received Norwegian Rewards CashPoints as usual, even though Curve was in the middle of the transaction.

- Are the insurances on the underlying card valid?

- Many credit cards include travel insurance if a sufficient part of the trip was paid with that card. We recommend asking your card issuer. Insurance validity is not guaranteed.

- Does Curve have security features?

- Curve now has very comprehensive security features. Strong customer authentication is used for large online purchases.

- Who is responsible for possible misuse?

- In case of card misuse or another incorrect charge, you must file a claim with the card issuer. The question is whether to file it with Curve or the card that was ultimately charged. We asked Curve support. If there is an incorrect transaction on the card, Curve is the primary point of contact for resolution.

- Does Curve support American Express cards?

- Unfortunately, Curve does not support Amex cards.

Our Rating of Curve

The Curve card and app make it effortless to route payments to different cards while keeping spending under control. Technically, the card has worked almost flawlessly, and customer service has been smooth, albeit a bit slow lately. As a no-monthly-fee card, Curve Pay is worth getting.

We rated Curve a 4-star card based on our experience.

Where Can You Order Curve?

Ordering Curve is easy. Install the Curve App on your phone and order the card there. The card arrives at home about 2 weeks after ordering. You can start using Curve even before the physical card arrives via Samsung Pay, Google Pay, or Apple Pay. You can find your virtual Curve card number in the app with a few taps right after ordering.

Curve occasionally offers a welcome bonus for new customers. The bonus is deposited in the Curve app, where you can use it for future purchases.

Download the Curve App via our referral link to receive any available welcome bonus. Curve’s welcome campaigns change from time to time, so check the current terms via the link.

Bottom Line

Curve is a sound payment card for those who travel outside the euro area. With no monthly fee, Curve delivers clear savings on currency conversion fees. The card also suits frequent business travellers who carry multiple cards. As with any payment card, use Curve carefully, and we recommend reading our more comprehensive article about Travel Credit Cards.

Because the base Curve is free apart from the delivery fee, trying it is the easiest way to see if the card suits you.

Learn more about the payment card on the card issuer’s website and submit your application!