Morrow Bank -Mastercard

The Morrow Bank credit card is a lesser-known payment method available in Finland. Its marketing has been fairly modest, but its feature set stacks up excellently against competitors. We decided to explore the Morrow Bank Mastercard and assess who this card suits.

A Bank From Norway

Morrow Bank was previously known as Komplett Bank. We also obtained its credit card and reviewed its features while the bank still operated under the Komplett Bank name. The card’s features barely changed with the rebrand, so it’s largely the same product. The name Morrow refers to the English word tomorrow—Morrow Bank is the bank of tomorrow.

Morrow Bank is Norwegian and operates only online. Its operating model is very similar to Bank Norwegian, which offers its Visa card in Finland. Morrow Bank specialises in loans but also offers a Mastercard-based credit card. Unlike Bank Norwegian, Morrow Bank does not offer a savings account to Finns.

Morrow Bank Credit Card in a Nutshell

The credit card issued by Morrow Bank runs on the Mastercard network. When used correctly, it’s completely free. There is no annual fee, and you typically get about 50 days of interest-free time to pay the bill. Once interest starts accruing, the credit becomes somewhat expensive, which is very typical for credit cards.

By using the card’s interest-free payment period, you can consolidate everyday spending onto a single bill at no extra cost. Using the credit, however, incurs interest, so pay the statement by the due date.

Morrow Bank states that the card can have a credit limit of up to €10,000, but limits are determined individually. Few customers receive such a high limit; for many, it will be notably lower. A limit of a few thousand euros is sufficient for everyday use.

When travelling, your credit limit needs to be high enough because hotels and car rental companies place temporary holds on the card as a deposit for their services.

Applying for the card has been made easy. Any Finnish resident over 23 with a clean credit history can apply at any time via the bank’s website. You can sign the application electronically, as we did, using Nordea’s online banking credentials. After approval, you choose your own PIN, and the card is delivered to your home in as little as a week.

The application process was surprisingly fast and very clear. You can order the card a few weeks before your trip, but we recommend applying well in advance.

Features

No Annual Fee

The Morrow Bank credit card is completely free when used correctly. There’s no annual or monthly fee, and you won’t pay interest on the bill if you pay it in full by the due date. Used otherwise, the card can generate significant borrowing costs.

If you don’t pay by the due date, the interest rate can exceed 19%. That’s expensive, so consider carefully whether to use the credit. Cash withdrawals with the card also accrue interest. Although the price list says cash withdrawals are free, that’s not the whole story. You start paying interest on cash from the moment of withdrawal until the bill is paid. In addition, currency conversion carries a 1.75% fee, which is typical for credit cards. The Morrow Bank Mastercard, therefore, shouldn’t be used for cash withdrawals in Finland or abroad; for cash withdrawals, the Bank Norwegian Visa card is a better fit.

Custom PIN Code

These days, almost all payment cards let you set your own PIN, and that’s also the case with the Morrow Bank Mastercard. You can choose your PIN after approval and before the card is shipped.

Apple and Google Pay Support

The Morrow Bank credit card supports Apple Pay and Google Pay.

Apple Pay and Google Pay support are handy additions to any payment card. You don’t need to carry the physical card at all times—you can pay securely with just your phone. That way, forgetting your wallet at home isn’t a problem if you still have your phone with you.

Rewards Program

The card’s rewards program is definitely its best perk. Morrow Bank offers 2% rewards on online purchases and 1% on other purchases. Rewards are cash you can use to pay future credit card bills.

Rewards are paid as points. Every 10 points equals one euro. So, a €100 online purchase earns 20 points, and an in-store purchase earns 10 points. These correspond to 2% and 1% cashback.

Compared with Bank Norwegian’s Visa card, the rewards system is more lucrative. You accumulate rewards faster and can use them for anything. Bank Norwegian’s Visa also offers 1% rewards, but as CashPoints that can be used only for Norwegian Air flights.

The Morrow Bank rewards program has a few limitations. You can earn a maximum of 2,000 points per year, equal to €200. Rewards accrue only on purchases over €5, so you won’t earn rewards on small purchases, which inevitably occur. This detail is mentioned only in passing in the card’s marketing text.

Even so, the rewards program is among the best on the market and is ideal for those who don’t want to tie rewards to specific uses like flights. If you travel less, the Morrow Bank Mastercard is a better choice than the Bank Norwegian Visa card.

Insurance

Another handy feature is the card’s insurance. It includes several free policies.

Travel Insurance

The travel insurance is valid when more than 50% of the trip is paid with the Morrow Bank card. This condition is the same as with Bank Norwegian’s Visa card. The insurance covers the whole family, which makes it better than Bank Norwegian’s credit card insurance. Instead of family, three travel companions can be insured, provided everyone travels the same itinerary. When the family travels, the cardholder doesn’t need to be present.

The travel insurance has a €100 deductible for illness and accidents. Baggage is also lightly insured. The coverage is surprisingly good, but it still isn't on par with traditional paid travel insurance. We always recommend taking a proper travel insurance alongside the card’s coverage. Credit card insurance is a useful add-on.

The insurance is provided by Gouda. It is valid for trips abroad lasting up to 60 days.

Rental Car Excess Waiver

A handy extra for travellers is the rental car excess waiver included in the card’s travel insurance at no additional cost. The insurance reimburses up to €1,000 of excess in the event of damage. The coverage isn’t limited to cars—it also applies to other vehicles such as a boat, scooter, or Segway.

Bank Norwegian sells a similar service to its Visa cardholders for an extra fee.

Purchase Protection Insurance

The card includes purchase protection against theft or damage of purchased items.

The insurance is valid for only 90 days and has a €50 deductible. It applies only if the item was paid for with the card.

Identity Theft Insurance

Identity theft is when someone uses your personal details without permission—for example, to apply for a loan—causing loss or costs. The Morrow Bank Mastercard includes free identity theft insurance that covers up to €10,000 of legal expenses to resolve issues caused by theft.

Our Experience With the Morrow Bank Credit Card

We decided to apply for the Morrow Bank credit card to get a better impression of it.

Applying for the Card

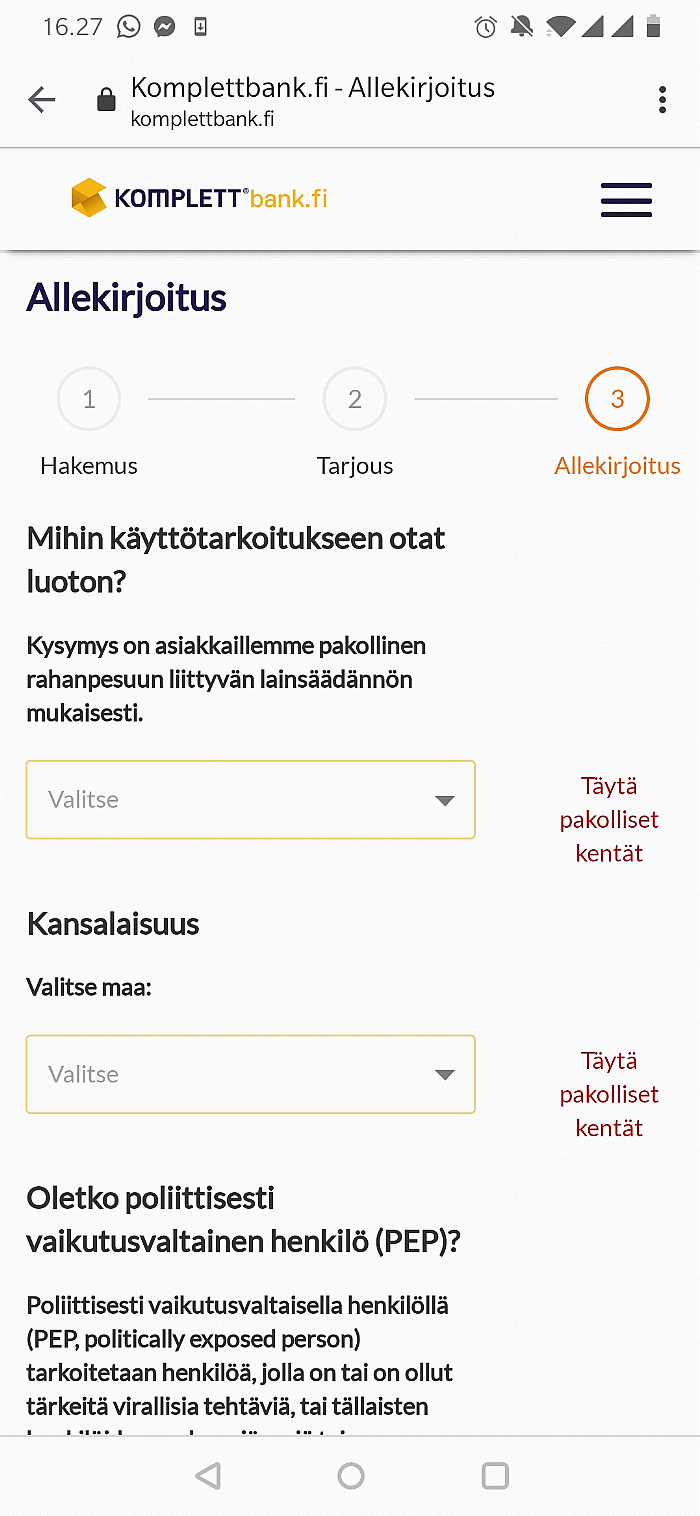

We applied for the Morrow Bank Mastercard through the bank’s website. Anyone over 23 with well-managed finances is eligible to apply. The simple form asked for personal details and information about our situation and income. After that, we received a preliminary decision with a credit limit in 30 seconds.

After the preliminary approval, we had to supplement the application. Morrow Bank asked anti–money laundering questions, as banks normally do. We also had to send the latest payslip electronically through a clear form. Overall, the application took only five minutes.

The final approval arrived by email after a few days. After that, we still had to choose a PIN. Once the PIN was selected, the bank created the physical card and mailed it. In total, it took about a week from starting the application to receiving the card.

If you don’t supplement the application with the requested information, the bank will remind you several times by email and text message. The application is signed electronically using a Finnish bank's credentials.

Morrow Bank App

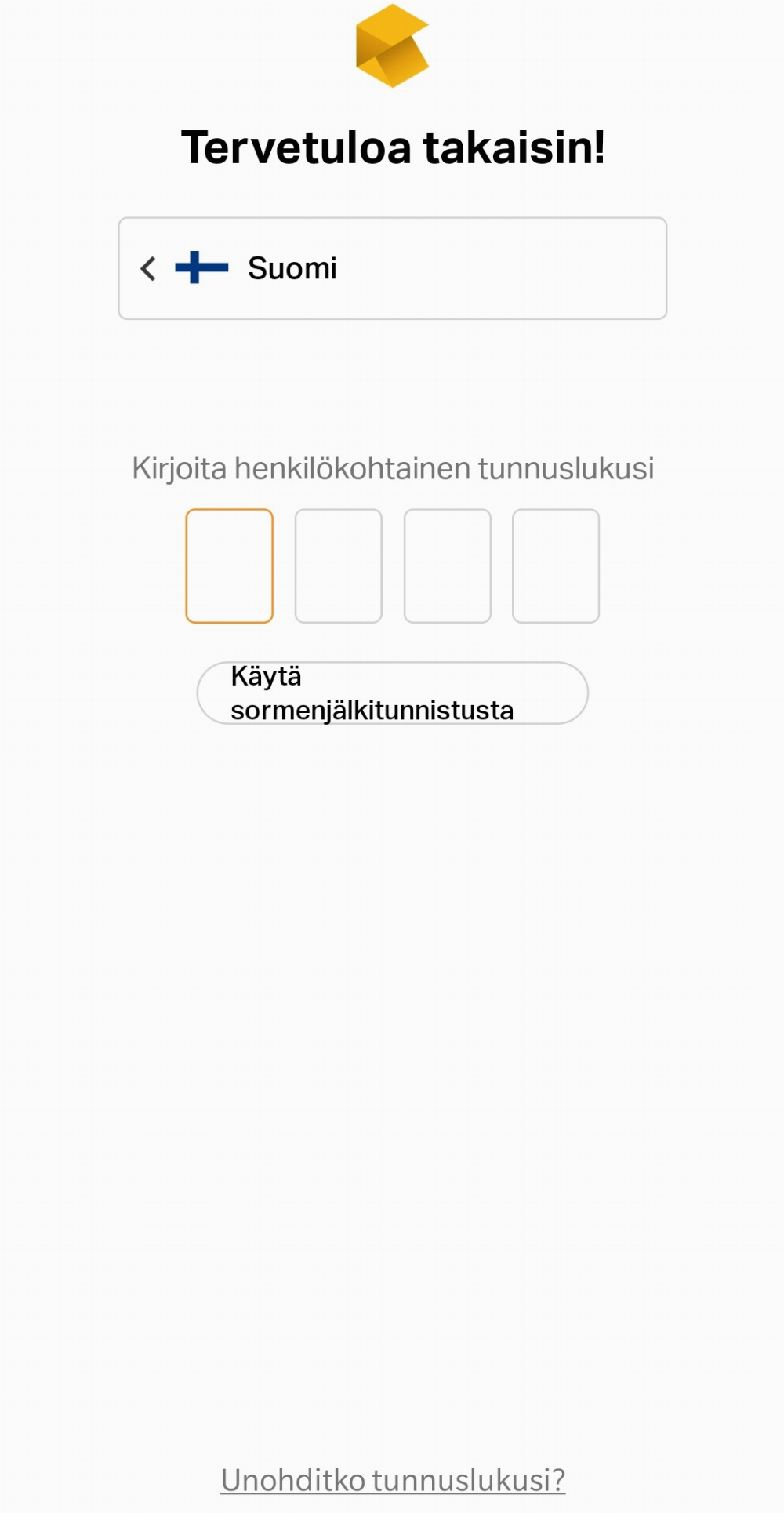

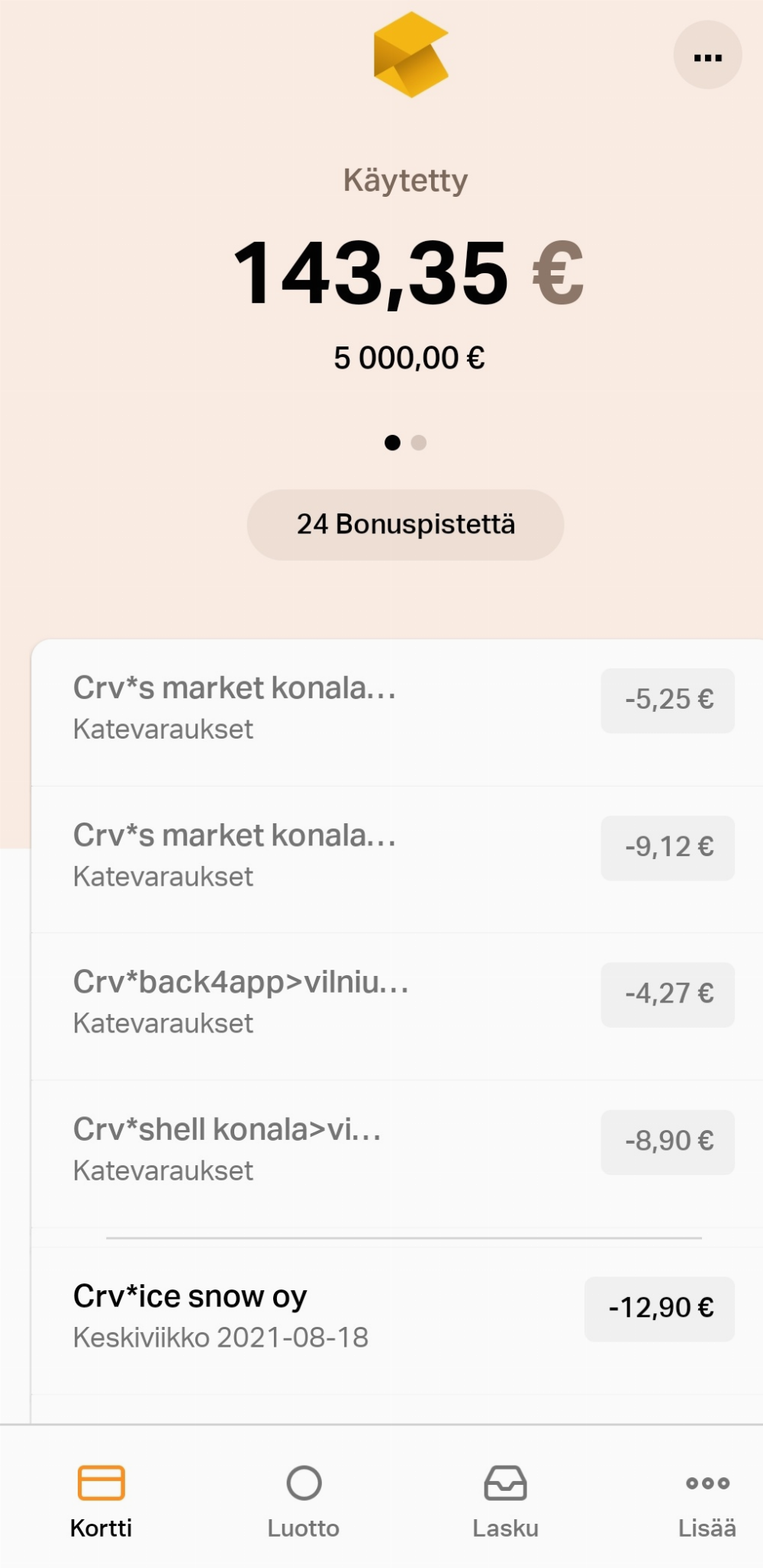

You can view and manage your Morrow Bank credit card details with the Morrow Bank app installed on your phone. The app is available in app stores, and installation takes just a moment.

The app is easy to use. After the first strong authentication, you can log in with your own numeric code or fingerprint. The app shows card transactions in real time and other account information. You can also view your statements. If needed, you can temporarily lock the card via the app, for example, if it’s misplaced.

Our Verdict: Is the Card Worth Applying For?

As a no-annual-fee card, Morrow Bank’s Mastercard is definitely worth applying for. The card includes many useful free features, even if the credit itself is expensive.

The card offers high-quality, comprehensive free insurance. The rewards program pays real cash, unlike Bank Norwegian’s CashPoints, which are tied to flights. With Bank Norwegian’s Visa, you might collect slightly more in annual rewards, but those must be used only for Norwegian Air Shuttle flights.

The card also has downsides. You don’t earn rewards on purchases under €5, which reduces the program’s value. ATM withdrawals aren’t free—you’ll pay a 1.75% currency conversion fee plus interest until the bill is paid. However, the many other features outweigh these minor shortcomings.

Explore all the features of the Morrow Bank Mastercard on the bank’s (linkkiä ei saatavilla) and apply.

Our Rating for the Card

The Morrow Bank card offers many valuable features for free, such as broad insurance coverage and a rewards program. For this reason, we rated the Morrow Bank credit card five stars.

Questions and Answers

- Where does the name Morrow Bank come from?

- Morrow Bank - Tomorrow Bank — conveys a sense of the future, positioning the bank as a forward-looking pioneer.

- How much does the Morrow Bank Mastercard cost?

- The card itself is completely free. Cash withdrawals incur interest and currency conversion fees. A late payment also incurs interest.

- What free insurance is included with the card?

- The card includes travel insurance, purchase protection insurance, and identity theft insurance. The travel insurance consists of a rental car excess waiver.

- Are cash withdrawals free?

- Yes, but you start paying interest on the withdrawn amount immediately until the due date. Currency conversion fees are 1.75% of the withdrawal amount.

- How much do purchases earn in rewards?

- Online purchases earn 2% rewards. Other purchases earn 1%. Purchases under €5 do not earn rewards.

- How can I use the tewards?

- You can use rewards to pay your credit card bill.

- Is the Morrow Bank Mastercard good for travellers?

- It suits travellers very well, thanks to the included travel insurance and rewards program.

- Do we recommend the Morrow Bank Mastercard?

- The card is worth trying. Its suitability depends mainly on your spending habits, which you’ll discover by trying it yourself.

Bottom Line

You could apply for the Morrow Bank Mastercard online easily, and delivery was fast. The card offers many valuable perks that, when used correctly, come at no extra cost. As such, it’s an excellent addition for travellers. The rental car excess waiver, in particular, benefits independent travellers.

There are numerous credit cards on the market. Morrow Bank’s card isn’t aimed directly at travellers, but it’s definitely useful while travelling. Thanks to its strong rewards program, the Morrow Bank card also works well for everyday use. Used properly, the rewards are extra money with no additional fees.

Learn more about the payment card on the card issuer’s No link and submit your application!