Alisa Pankki

Alisa Pankki is a Finnish online bank founded in 2022 for consumers and SMEs. Deposits are covered by the Finnish deposit guarantee scheme. The bank has no physical branches; it is a pure mobile bank like most newer banks. You handle banking via the mobile app or the website. Behind these channels are traditional banking professionals who help with everyday banking questions. The mobile app replaces physical branches and lowers the bank’s costs. Customer service is also available by phone, but the number is premium-rate.

Alisa Pankki previously specialized in brokering peer-to-peer loans.

It’s easy to become an Alisa Pankki customer. The simplest way is to install the Alisa Pankki mobile app and set up your account through the app. For identification, you need another Finnish bank’s credentials or a Mobile ID, after which the mobile bank is immediately available. You can become a customer in under 15 minutes at any time of day.

You can also join via the website without installing the mobile app.

Service Offering

Alisa Pankki’s service offering is still limited. For account holders, the bank offers current, savings, and fixed-term accounts. Their interest rates are among the highest on the market. The bank also offers consumer loans.

The bank’s newest service is a debit/credit Visa card with credit.

Visa Credit Card

Alisa Pankki issues Visa credit cards to employed people and students. You can pay directly from an Alisa Pankki current account or on credit. Payments work in brick-and-mortar stores and online, provided the merchant supports Visa card payments. Almost all merchants accept these today. Card use is not limited to Finland; it also works well abroad.

Eligibility Criteria

Alisa Pankki’s Visa card may be granted to an adult who has income and no payment defaults. Exact eligibility criteria are typically business secrets, and that is likely the case with Alisa Pankki as well. You only find out if you qualify by applying for the card.

Visa Card Features

Credit Limit

The typical credit limit is only €1,500, which is low. For travellers, this often isn’t enough. While €1,500 covers hotel stays and flights, it’s not sufficient for a car rental. Rental companies often place a hold of over €1,000, quickly exhausting the card’s limit. For travelers, we recommend the Bank Norwegian Visa Card or the Morrow Bank Mastercard thanks to their higher limits and travel-friendly perks.

Physical and Virtual Card

You can start using Alisa Pankki’s Visa card immediately after approval. At first, you can use the card only for contactless and online payments via Alisa Pankki’s mobile app. You can order a physical card in the app, and it will be mailed to your home later. You can still get started right away with the virtual card.

The card does not yet support Apple Pay or Google Pay, which is a significant gap. You can work around this by getting the digital Curve wallet, which makes it easier to manage multiple payment cards.

Getting the card is free.

No Recurring Service Fees

Alisa Pankki’s Visa has no monthly fee if you do not use the credit feature. Otherwise, the monthly fee is €2.90. Purchases left on credit accrue interest after the due date. In other words, if you pay the bill by the due date, there are no additional costs.

Security

The card uses Visa 3D Secure authentication, where two different methods verify the user during an online purchase to prevent misuse. This is standard across all payment cards and reduces fraud.

Fees and Charges

There are no ongoing fees with Alisa Pankki’s Visa card. Purchases made with the card are billed monthly, and you typically get an average of 45 days of interest-free payment time. After that, any remaining balance moves to the credit and starts accruing interest. The interest rate starts at 9.9% + 3‑month Euribor, but the actual rate depends on your financial situation.

Currency conversions use Visa’s wholesale rates plus a 1.5% fee. While this isn’t the highest conversion fee on the market, you get clearly better exchange rates with the Curve and Wise cards. We recommend these payment methods primarily for purchases outside the euro area.

Avoid ATM withdrawals with Alisa Pankki’s card. Regardless of the currency, an ATM withdrawal costs €3 + 2%. Thus, withdrawing €100 incurs a fee of €5, which is unreasonable. In any case, Alisa Pankki’s card is intended for in-store and online payments, not ATM use.

Our Rating

We rated Alisa Pankki’s Visa card 3 stars for being fee-free and easy to apply for. The card lacks notable extra features or perks, which is why we didn’t award more stars. As a basic card, Alisa Pankki’s Visa is a solid product.

Experiences With Alisa Pankki

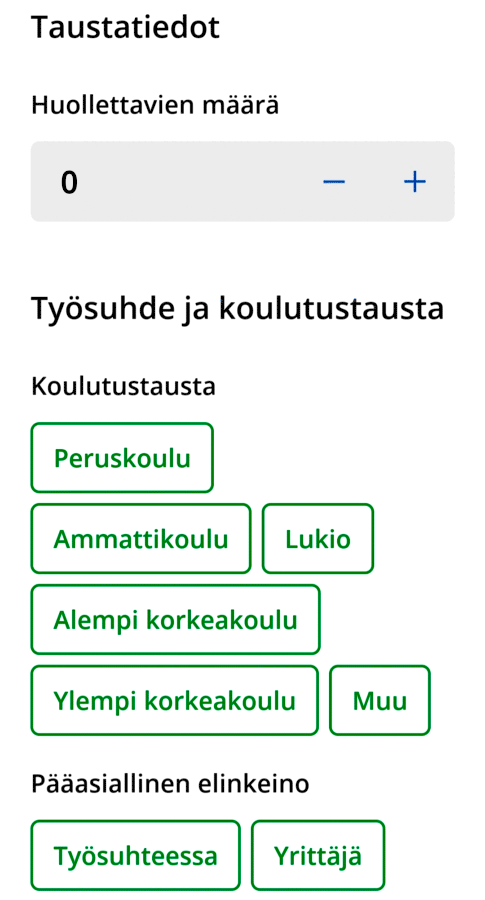

We tested the application process for Alisa Pankki’s Visa card in the mobile app. The app asked for background information about our financial situation and requested permission to check our credit. It then showed the card’s fees and interest level.

We were surprised that the offered interest rate clearly exceeded the advertised starting rate. Credit cards typically offer the same interest rate to all customers, but that does not appear to be the case with Alisa Pankki’s Visa card. We declined the offer because we did not need Alisa Pankki’s card.

The application process itself was easy and very clear.

We are following the development of Alisa Pankki’s Visa card features. If Alisa Pankki launches a rewards program for the card, we will take another look, and that might be a good reason to start using the card daily. For now, however, the card does not provide sufficient added value, as there are better no-fee cards on the market. A small shortcoming worth noting: a few months ago, the bank’s website had non-working links. These have likely been fixed now.

Who Is Alisa Pankki's Visa For?

Alisa Pankki’s Visa is well-suited for students as a first card. The card is basic in features and has no recurring fees. It offers no special advantages for travellers, but it works well as a backup card. If you already have a current account with Alisa Pankki, it’s natural to get the payment card linked to it as well.

Questions and Answers

- Does Alisa Pankki's Visa Card Have A Rewards Program?

- The card does not currently have a rewards program.

- Who Can Get Alisa Pankki's Visa Card

- Applicants must be adults and have their finances in order. The bank makes the final approval decision, and the exact criteria are business secrets.

- Does The Card Have Recurring Fees?

- There are no recurring fees if you pay your bill by the due date.

- Does The Card Support Google Pay?

- Unfortunately, no.

- Does the Card Support Apple Pay?

- Unfortunately, no.

- Does The Card Include Insurance?

- The card does not include insurance.

- Does The Card Offer Special Perks?

- The card does not include special perks.

- How Quickly Can You Get The Card?

- You can get a virtual card in 15 minutes. You must apply in Alisa Pankki's mobile app.

Bottom Line

Alisa Pankki’s Visa card was an excellent choice for a student’s first credit card. For anyone who already had other cards, the Alisa Visa served as a backup thanks to its fee-free nature. No fees apply as long as you pay your bill by the due date. It is also worth getting if you already have a current account with Alisa Pankki. A simple application process, a well-functioning mobile app, and acceptance by all Visa-accepting merchants make paying with Alisa Pankki’s credit card easy.

The Visa card’s features are still limited, but we believe this is just the starting point. The card’s features are continually being improved. For that reason, you can get the card now even if you do not yet plan to use it actively.

Alisa Pankki’s Visa card does not yet stand out with its features, but it is still a perfectly decent credit card.