Revolut in a Nutshell

Revolut is a banking services company founded in the UK in 2015 by Nikolay Storonsky and Vlad Yatsenko. Revolut holds a banking license issued in Lithuania, which enables it to offer banking services in certain EU countries. In the UK, Revolut applied for a banking license only in 2021. The bank has thousands of employees and has become profitable.

Revolut’s flagship product is a debit card bundled with a range of extras. Revolut lets you hold money in multiple currencies, send funds easily to other Revolut users, and place investment orders. Revolut is a modern, versatile mobile bank without physical branches.

Is Revolut Like Wise?

Revolut and Wise share many features, but their focus differs. Revolut is a full-featured mobile bank, whereas Wise primarily focuses on money transfers and currency exchange. The gap has narrowed, though, as Wise looks more like a mobile bank each year, and Revolut has added Wise-like functions. Today, Wise and Revolut complement each other well, and both hold clear market positions.

Read our Wise Review.

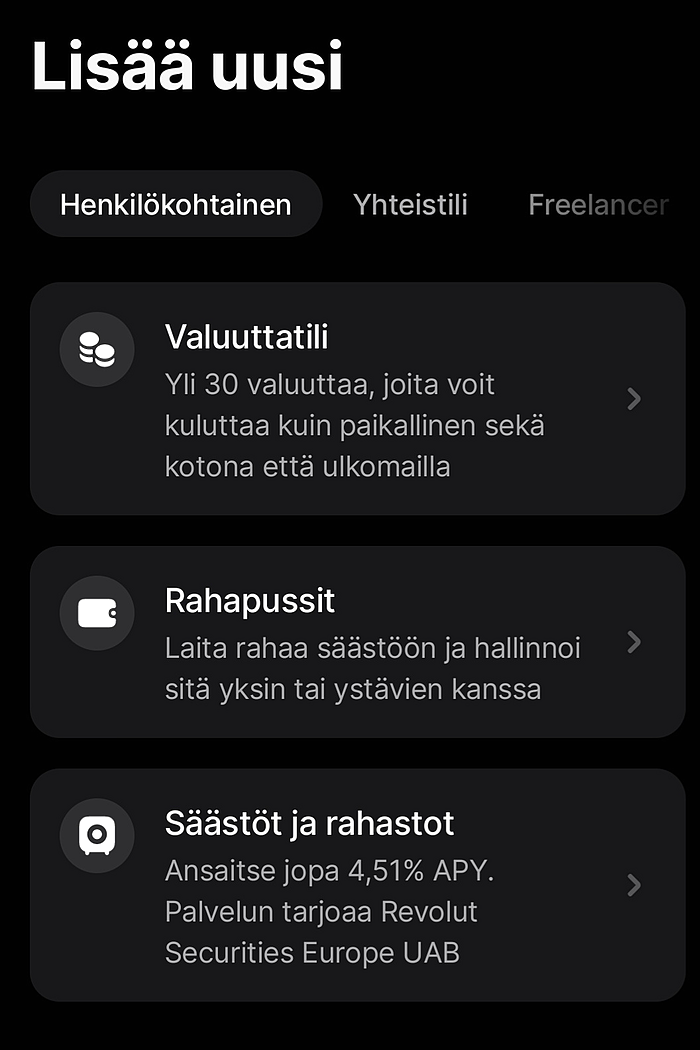

Revolut Services

Revolut is not just a card but a suite of banking services. The offering is broad and covers many types of banking needs. The range of services, their features, and pricing vary by your Revolut subscription tier.

Bank Account

Revolut creates a euro-denominated bank account with an IBAN for regular transfers. Receiving and sending SEPA transfers is free. The SEPA area (Single Euro Payments Area) covers 36 European countries where euro payments follow unified rules.

Currency Accounts

You can open currency accounts in Revolut and deposit major currencies, such as US dollars. You can also make international transfers from these accounts. Fees vary by destination country and currency. Moving money and exchanging currencies between your own Revolut accounts is free — or at least inexpensive — depending on your tier.

Insurance

Paid Revolut tiers include a set of insurance benefits. These include purchase protection, fraud coverage, travel insurance, rental car insurance, and trip cancellation insurance. We share more details in the section outlining Revolut’s subscription tiers.

Learn about travel insurance

Payment Cards

You can order physical payment cards for your Revolut accounts. The cards have no monthly fee, but creating and delivering a physical card may cost money. If virtual cards are enough, you can make them in the app for free. Virtual cards work well with the Curve Pay app, so a physical card is often unnecessary. Revolut also lets you create disposable card numbers, valid for riskier online marketplaces.

The number of free Revolut cards depends on your tier. There is also an absolute cap on the total number of cards, regardless of tier.

You can link an individual card to a specific Revolut account. That way, one card can pay from a dollar account and another from a euro account. You can also set a card to use all accounts, and Revolut will automatically perform any necessary currency conversions.

Joint Accounts

You can open an account with a partner, friend, or anyone else. The funds are shared, and both parties can manage them through their respective mobile apps. You can also order or create a dedicated card for the joint account.

Linked Accounts for Under-18s

An adult Revolut user can create a Revolut profile for one or more children. The adult can see the child’s account details in their own app, while the child can install the app on their phone and receive a card to use the funds. The maximum number of linked accounts depends on the adult’s Revolut tier.

A parent manages under-18s’ Revolut accounts and is responsible for their use.

Revolut Pro

Revolut Pro is an add-on within Revolut. It targets freelancers, sole traders, and microbusinesses and offers a free business account option. It includes a separate IBAN and both physical and virtual cards. Revolut Pro itself doesn’t add to your regular Revolut monthly fee, but accepting customer payments does cost money. Revolut Pro users can accept payments via card and QR codes, among others. This keeps business expenses separate from your other Revolut spending. You can also earn up to 1% cashback on all card purchases, which can benefit active Revolut Pro users.

Revolut Pro differs from a Revolut Business account because it’s meant for sole proprietors and doesn’t require company registration. It’s available in the Revolut app and lets you manage income, expenses, and payments easily.

Interest-Bearing Funds (Flexible Cash Funds)

You can seek a better return on your Revolut balance by allocating money to Revolut’s cash funds. This comes with a small investment risk. Yields vary by currency and Revolut tier, typically between about 2% and 5%. You can transfer invested funds back to your regular Revolut account at any time, making them a simple, liquid option.

Stocks, Commodities, and Crypto

Through Revolut, you can also trade stocks as well as ETFs, commodities, and crypto. Before you place your first trade, Revolut confirms that you understand investment risks through a questionnaire. Trading fees are reasonable compared to those of traditional banks.

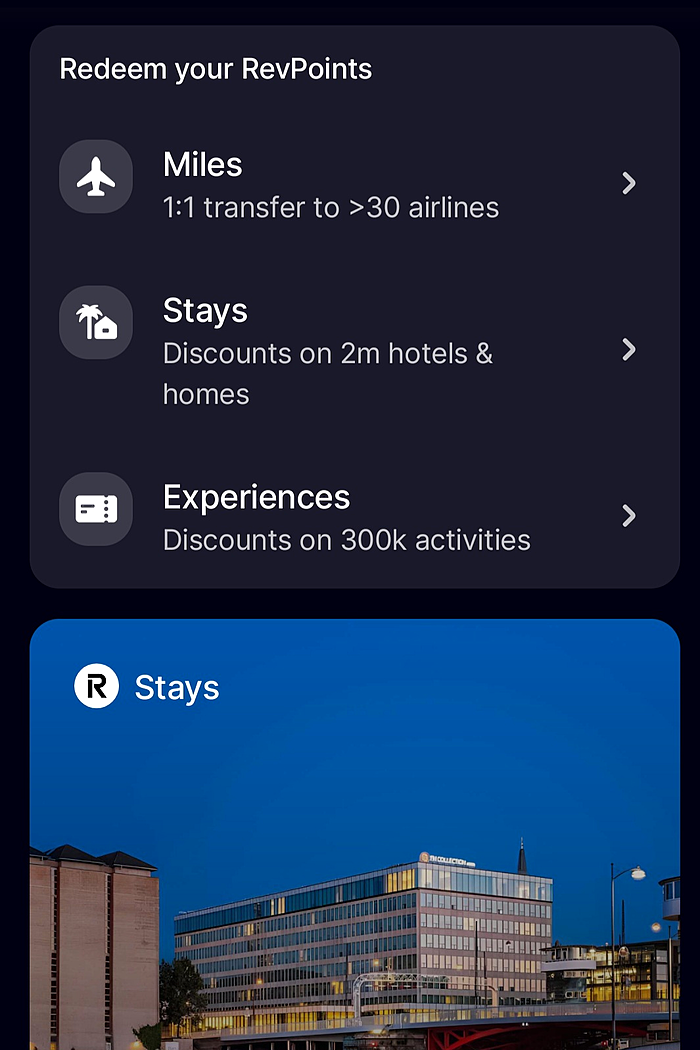

RevPoints

RevPoints is Revolut’s rewards program. Purchases made with a Revolut card earn points you can redeem for rewards. You can transfer RevPoints to airline loyalty programs or use them to book hotels. The earn rate depends on your tier, but is slow on the lower tiers.

Extras: Lounges, eSIMs, and More

Beyond banking services, Revolut sells other add-ons such as airport lounge access and eSIMs. Prices vary by tier and can even be free at the top end.

SmartDelay is a Revolut add-on that many travellers appreciate. With SmartDelay, you can get a free lounge visit if your flight is delayed by more than an hour and you have activated the service beforehand. Review the terms carefully to make the most of the benefit.

Read about the lounges at Helsinki Airport

Revolut Subscription Tiers

Revolut’s offering is extensive, so it’s worth studying its features carefully. We’ve compiled a summary of Revolut’s tiers, but we recommend checking the details on Revolut’s own website. Features and pricing can change quickly.

At the time of writing, there were five tiers. As a rule, each higher tier adds more features than the one below it.

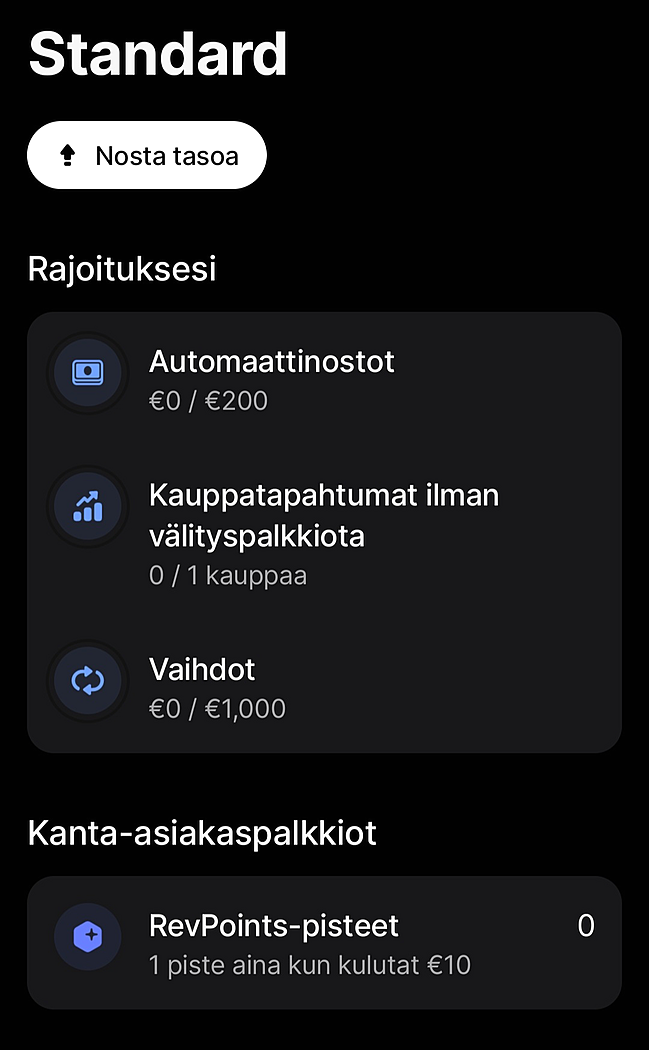

Revolut Standard

A Revolut Standard subscription has no monthly fee. It includes one physical Visa or Mastercard debit card, virtual cards, and an IBAN. Virtual cards are available immediately, while physical cards take a few weeks to arrive. Revolut charges a delivery fee for a physical card. Virtual cards are free.

Your euro-denominated Revolut account includes an international IBAN, and transfers within the SEPA area are free. Even weekday currency exchanges are free up to €1,000 per month; after that, the conversion fee is 1%. Funds in the account don’t earn interest, so Revolut isn’t ideal for savings. Instead, you can allocate money to Revolut’s cash funds (Flexible Cash Funds) to earn a small yield for some risk. You can redeem money from these funds back to your regular Revolut account.

The Standard tier supports one linked account for children. If you need more linked under-18 accounts, you’ll need to move to a paid tier.

You can trade stocks, ETFs, funds, commodities, and crypto with Revolut regardless of tier. On Standard, one stock trade per month is free.

Standard cardholders earn one RevPoint for every €10 spent. EEarningsiareslow.

Standard-tier members can visit airport lounges for a €34 per-visit fee. China’s DragonPass provides the services. You can also buy eSIMs in the app..

Revolut Standard suits occasional travellers. For purchases and ATM withdrawals, monthly currency exchanges are free up to €1,000, but ATM withdrawals are free only up to €200. After that, there’s a 2% cash withdrawal fee. RevPoints accrue slowly, so the benefit is limited on Standard.

Revolut Plus

Revolut Plus is a slightly upgraded paid option. Its base price is €3.99/month, which is very reasonable.

Revolut Plus adds features over Standard. It includes two physical cards. You can make fee-free currency exchanges up to €3,000 per month, and withdraw up to €400 from ATMs with no fee. Plus, it also includes purchase protection. RevPoints accrue faster than on Standard. You can link two under-18 accounts instead of just one.

Revolut Plus suits users who find Standard mostly sufficient but want additional insurance and slightly better yields on cash funds. Needing to link multiple under-18 accounts is also a good reason to choose Revolut Plus.

Insurance terms are complex, so review them on Revolut’s website.

Revolut Premium

A Revolut Premium subscription costs €9.99/month. At a higher price, the tier includes several extras. You can also choose from multiple card designs to get a card that suits your preferences.

The free ATM withdrawal limit on Premium is €400. There’s no cap on fee-free currency exchanges - you can exchange currencies without limits. The card includes travel insurance plus all insurance from the Plus tier

Revolut Premium users get seven free subscriptions to well-known services. These include NordVPN, Tinder, and Wolt, among others. NordVPN is especially useful for travellers.

Revolut Premium is best for frequent travellers, since the card includes travel insurance in addition to other coverage. Revolut also offers the cardholder and a friend a free visit to an airport lounge if a flight is delayed by more than an hour. Other lounge visits cost €24, which is competitive.

Revolut Metal

Revolut Metal is the best tier, featuring a metal card, as the name suggests. It costs €15.99/month, which makes it a bit pricier.

In addition to the insurance listed above, Metal includes rental car excess insurance. You can withdraw up to €800 from ATMs with no extra fee. You also get free subscriptions to all of Revolut’s partner services, which by our count total 12. Beyond those already mentioned, the list includes Financial Times and WeWork, among others.

Revolut Metal suits an active, style-conscious traveller who wants the best insurance and a card that looks as premium as possible. Revolut Metal can be a good choice for users who value extras more than a low price.

Revolut Ultra

Revolut Ultra is the top tier—and it’s expensive. It costs up to €60 per month.

The card includes a set of valuable extras. You can visit airport lounges without any fees, as often as you like. You can withdraw up to €2,000 per month from ATMs with no fee. Each month, you get a free global eSIM with 3GB of data. You also get significant discounts on international transfers.

Ultra includes an interesting cancellation insurance that lets you cancel a trip for any reason and get 70% of the costs back. This insurance also has complex terms, so study them carefully.

Revolut Ultra suits travellers who fly several times a year thanks to unlimited lounge access and the eSIM perk. The broad cancellation cover enables you to take advantage of low fares. However, we don’t recommend Revolut Ultra as your primary travel card, since American Express Platinum offers even better benefits at nearly the same price.

Google and Apple Pay Support

All Revolut cards work with Google and Apple Pay. In that case, the merchant doesn’t receive your real card details—only a virtual card number tokenised by Google or Apple. This makes paying safer and smoother, and your phone alone is enough to complete the transaction.

Curve Pay is a credible alternative to Google and Apple Pay. It’s a more versatile mobile wallet with a free basic tier.

Our Experiences With Revolut

We joined the Revolut Standard tier to get hands-on experience. We hadn’t upgraded to paid tiers yet—we first explored the app’s benefits at no cost. We saw significant potential in Revolut and would likely become paying users later.

The Revolut App

We installed the Revolut app on our phones. Installation and the related identity verification went smoothly. To get started, we submitted photos of an ID and a few-second verification video. After these steps, the app was ready to use.

Revolut accounts — like other mobile-bank accounts — are managed via the app installed on your phone. In practice, Revolut is a mobile bank: everything from opening the account happens in the app. The app provided a quick overview of balances and spending, including statistics. Card tasks like locking the card and changing the PIN were handled in the app..

In our experience, the Revolut app worked well, but its wide feature set made it feel a bit confusing at first. We became familiar with it quickly.

Creating and Ordering a Card

We ordered a physical card through the app and created virtual cards. The virtual cards worked immediately when linked to Curve Pay. The physical card arrived by mail in a few days.

We deposited money into our Revolut account using Google Pay. The top-ups were fast and free. Funds were available instantly. As Curve Pay users, we were pleased to discover that it integrates with Revolut.

Our Verdict on Revolut

We rated Revolut a 4-star mobile bank based on our experience and research. Technically, the mobile app and its processes worked excellently. Revolut’s service lineup is also quite broad, so the bank has clearly come of age. There may even be too many features for basic users, making it time-consuming to grasp the whole picture.

Bottom Line

We had heard about Revolut years ago, but only decided to try it ourselves now. The reality exceeded expectations: Revolut was a polished mobile bank with a broad feature set. The paid tiers were reasonably priced, so active users could easily get value for the monthly fees.

For new users, the biggest challenge is the sheer number of features. Revolut isn’t just a payment card; it’s a complete package of banking services. The likely core audience is young travellers, but Revolut also suits many others. Before subscribing, it’s worth reviewing the terms and service descriptions carefully.

Often, after testing a payment card, we close it as unnecessary. That didn’t happen with Revolut. It became part of our daily routine alongside the Curve Pay app..