This article may contain affiliate links to commercial services.

What Is Wise?

Wise isn’t a traditional bank, but it works much like one. Wise lets you hold money in multiple currencies, and converting between currencies is easy and clearly cheaper than with conventional banks. The company originally came from Estonia. Today, its headquarters are in London, United Kingdom.

Wise’s original mission was to make cross-border money transfers easier while cutting fees. The service was aimed primarily at immigrants who regularly send money back home. Since launch, Wise’s concept and audience have expanded, and today Wise is no longer just a money transfer service.

Although Wise isn’t a licensed bank, you can use it much like one. You can hold funds on your own Wise balances in several currencies. You can also receive traditional bank transfers to your balances in major currencies, and you can send money from Wise to regular bank accounts. Wise provides modern international transfer services that let money move across borders in moments.

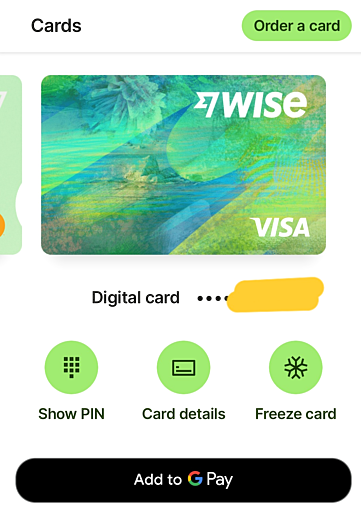

Wise Card

You can order a Wise Visa for use with your Wise balances. It’s a debit card, so you can never spend more than you’ve deposited into Wise. That makes the card very safe for anyone.

You can pay with the Wise card anywhere Visa is accepted, in stores and online. The money is taken from your Wise balance in the same currency as the charge. If your Wise balances hold only other currencies, Wise automatically converts to the target currency—at rates significantly cheaper than those of banks. As a result, using the Wise Visa abroad is cheaper than using cards from ordinary banks.

Benefits of Wise

The advantages of the Wise card stand out especially when you use a currency other than your home currency. Wise is an excellent choice for travellers, digital nomads, and anyone who often shops from abroad.

Deposit Money in Multiple Currencies

You can deposit money into Wise in almost any currency. For certain currencies, you also get a real account number to receive bank transfers from outside Wise. You can receive standard bank transfers in the following currencies: AED, AUD, BGN, CAD, CHF, CNY, CZK, DKK, EUR, GBP, HKD, HUF, ILS, JPY, NOK, NZD, PLN, SEK, SGD, TRY, UGX, ZAR. For other currencies, only outgoing transfers from Wise are possible.

You can also deposit money into Wise’s internal savings jars (jar in Wise’s terms) in the currency you want. Funds in jars can’t be used for bank transfers or purchases. It’s a handy way to keep everyday spending separate from savings.

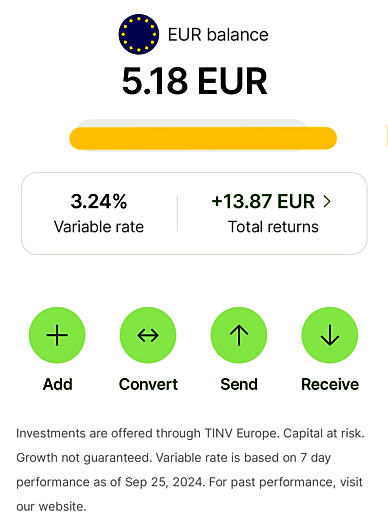

Earn Interest on Your Money

Funds in Wise generally don’t earn interest, with a few exceptions. For euro, pound, and dollar balances, you can choose to keep funds as cash or in funds linked to government bonds. In the latter case, your money earns interest that varies with market conditions. The funds remain available for normal use. The downside is a small risk of losing money or a drop in value.

Low-Cost Currency Conversions

Banks typically charge even more than 2 per cent for currency conversion, substantial charges under 0.5% for many currency pairs, which are clearly lower than banks' charges. Wise is a cost-effective way to exchange currencies. For example, before a trip, you can convert in advance when the exchange rate is favourable.

International Transfers

Through the Wise app, you can send money abroad even in currencies that you can’t hold in Wise. In that case, it’s enough that the recipient has a bank account in the country you want to send money to.

Incoming Transfers From Abroad

You can receive regular bank transfers to your Wise balance in major currencies. You get account numbers to which transfers should be sent.

Wise Fees

Opening a Wise account is free.

Visa

Getting the Visa costs 7 euros. It’s a one-time fee, so there are no recurring costs like annual fees.

The virtual Visa card is free. Its details appear in the Wise app right after you sign up. If you use Google Pay to pay in physical stores, you only need the virtual card. It also works smoothly for online purchases.

Depositing Money

Depositing money into your Wise balance is free if no currency conversion is needed with the deposit. If you deposit in a different currency, you’ll also pay conversion fees.

Paying for a deposit by card is a paid extra service. In our experience, moving money from a Finnish bank to Wise typically takes under a minute.

Currency Conversion Fees

Currency conversions in Wise are inexpensive. They generally cost under 0.5% of the amount exchanged, which is very affordable. Ordinary banks and credit card companies often charge up to 2 per cent.

Bank Transfers

Transferring money from your Wise balance to a regular bank account without conversion incurs a small transfer fee. Any currency conversion fees are paid separately. You can move money from Wise to your own bank account without transfer fees, but you’ll still pay any conversion costs.

Using the Card

There’s no fee for using the Wise Visa in stores or online. If you don’t hold the currency of the purchase in Wise, the payment is taken from another currency balance, and you’ll pay the related conversion fee.

Our Experience With Wise

We opened a Wise account years ago and ordered a Wise card.

Opening a Wise Account

Opening a Wise account took 5 minutes on Wise’s website. We provided personal details, created an account, and uploaded a photo of an ID document. The process was quick and easy. Right after opening the account, you could order a Wise Visa, which cost 6 euros at the time.

The card arrived at home in about a week. To activate it, we installed the Wise app on the phone and entered the activation code printed on the card. After that, we received the card’s PIN code.

Depositing Money

We deposited money into our pound-denominated Wise balance using the app.

First, we chose how much to deposit and in which currency. We selected the amount and set it to pounds. Then we selected the currency to pay with and chose euros.

The deposit itself was free, but the currency conversion cost about 0.45 per cent. The money had to be sent from our own bank to Wise using the bank details provided by Wise. Because it was the first deposit in pounds, we had to send Wise a photo of our ID card and a selfie.

We could also have paid by debit or credit card, but then there would have been a roughly 5 euros instant transfer fee.

Nowadays, there are more payment methods, and the service fees are even smaller. A bank transfer is a convenient and free way to move money into Wise.

After our first deposit, Wise continued to develop, and today you can transfer from your own bank to Wise via Wise’s Open Banking partner. You no longer need to make manual transfers—the service automatically moves the funds, authorised by you, from your Finnish bank. This way, the money reached Wise in minutes and, best of all, without fees!

A manual bank transfer is still a possible way to deposit funds into Wise. If the transfer isn’t urgent, a manual transfer is still a viable option because no Open Banking partner is involved.

Using the Wise Card

We used the Wise card like any debit card. The transaction currency determines which currency balance is charged. If that balance didn’t have enough funds, the payment was automatically debited from another Wise balance.

Transferring Money Between Wise Users

Transferring money between Wise users was especially convenient and fast. While on vacation in Indonesia, we sent Indonesian rupiah to each other almost in real time. There were no service fees because no currency conversion was required.

When travelling in a group, it’s convenient if every traveller has their own Wise account. You can then transfer local currency between travellers without fees.

The Wise App

Wise balances are easy to manage with the Wise app. The app supports biometric authentication, making it easy to use securely.

On the home screen, you can quickly see recent activity and the balances of your Wise accounts. On the Account tab, you can see your available account numbers. You can make transfers with the Send feature.

Wise Security

Wise isn’t a bank, so no state guarantees your funds. Wise safeguards client money at regular banks, where the funds are kept separate from Wise’s own money. Even if Wise went bankrupt, customers’ money would still be safe at the safeguarding banks in segregated accounts. You could only lose money if the banks that hold the funds became insolvent.

Our Rating of the Wise Card

Wise Visa is excellent for its purpose. You can hold money in different currencies, and converting between them is easy and affordable. Using the card to pay in multiple currencies is straightforward.

Questions and Answers

- Is Wise a bank?

- Wise is not a bank, but it offers nearly the same services.

- How much do currency conversions cost in Wise?

- Conversions typically cost under 0.5%, but rates vary by currency pair.

- Is the Wise card free?

- No, but there’s a one-time fee of 7 euros. There are no ongoing charges.

- Can you transfer funds from Wise to regular bank accounts?

- Yes, you can.

- Who is Wise Visa for?

- The card suits people who make ATM withdrawals and purchases in multiple currencies.

Do I Need a Wise Card?

For frequent travellers or those who make online purchases outside the euro area, Wise is a must-have. Wise is also almost essential for immigrants who send money to their home countries.

Wise has no ongoing fees, and the card costs only 7 euros. You can preload your Wise balances in currencies you expect to need later. You can convert well before your trip when rates are optimal. You can also make bank transfers from Wise to regular accounts abroad, and Wise also enables receiving transfers in several currencies, such as US or Singapore dollars. The Wise app, together with the Wise card, is a practical tool for anyone who frequently handles currencies other than euros. Alongside Wise, we recommend the Curve Pay, which is an excellent companion, especially for travelers.

Learn more about the Wise Account.

Bottom Line

Wise is a top choice for anyone who sends money across borders and needs currency conversion along the way. The Wise card likewise suitravellersers. You can convert currencies cheaply in advance, then pay for goods priced in a foreign currency with the money on your Wise balances using the Wise card. You save 1-2% compared to ordinary banks.

Learn more about the payment card on the card issuer’s website and submit your application!