American Express Platinum

American Express Platinum, or the Platinum Amex for short, is one of the best charge cards available in Finland. The card comes with valuable perks but, in return, is also expensive. Although it is marketed with a wide range of benefits, it is also a status symbol for some. American Express offers an even more exclusive card, the Centurion, but only very wealthy individuals can get it, and only by invitation. In practice, Amex Platinum is the best Amex card a regular consumer can obtain.

The Platinum Amex has no exact like-for-like competitors in Finland, but Revolut Ultra is comparable in certain respects. OP's Platinum Card also approaches American Express Platinum in both price and features. The Nordea Platinum, launched at the end of 2025, is perhaps the best value alternative to the American Express Platinum; we may switch to it if American Express Platinum doesn’t add more perks.

American Express Platinum is a premium charge card, as the price suggests: €780 per year, billed as €65 monthly. At the same time, the market offers plenty of good cards that are free or inexpensive, so customers have the right to expect strong value for the fee. We had used the Platinum card before, but ended up cancelling it as it was too expensive. We then ordered it again and gave it a new chance to win us over. We have now been using the card for over a year.

Applying for the Amex Platinum Card

You can apply for American Express cards through Amex’s website. The income threshold for the most common Amex cards is about €20,000 per year. This is not stated on the site, but Amex customer service told us this figure. Many other factors still affect approval, so decisions are always made on a case-by-case basis. You must have the finances to get the card.

Our Experiences With the Application Process

We applied for the Platinum card through Amex’s website. This was our second time applying, and we noticed the process had become smoother than before.

The steps were very standard. We had to provide basic information, verify our identity, and authorise American Express to check our credit file and bank account transactions. The decision was not immediate; it arrived a few days later via text message. After approval, the card and its PIN arrived by post within 2 weeks. To use the card, it had to be activated with the Amex FI app installed on the phone. Activation was easy and took under a minute. We were also advised to install the Amex Experiences app, which presents the card’s benefits clearly. The app is practically essential for using the perks, as it contains the Access Cards needed to redeem them.

We also ordered the free supplementary card, and applying for it was even smoother.

Referral Link

Anyone can apply for the Amex Platinum card, but applying via a referral link is by far the most advantageous. Every Amex Platinum member can refer at least three people per year. In November, members likely received one extra referral link. Applicants approved through a referral receive 100,000 Membership Rewards points, and sometimes there is an increased bonus, for example, 150,000 points.

For many applicants, the challenge is finding a valid referral link, as the Amex Platinum is not a very common card. Links also may not be shared openly on forums; you may recommend the card only to someone you know.

We cover Membership Rewards in more detail in the Benefits section of this article.

American Express Platinum Benefits

Because the Amex Platinum annual fee is close to €1,000, cardholders have the right to expect high‑quality benefits. Below are the key perks and our opinions of them.

Airport Lounges

The card’s best benefit is definitely unlimited complimentary access to airport lounges. Both the primary and supplementary cardholders can join Priority Pass free of charge, which entitles the cardholder and one guest to unlimited visits at over 1,600 lounges worldwide. At Helsinki Airport, for example, the Aspire Lounge and Plaza Premium Lounge accept Priority Pass membership.

Revolut Ultra also offers unlimited lounge access.

You can also buy Priority Pass outright for €459 per year, but the Priority Pass included with Platinum is clearly better since it admits the cardholder’s guest for free as well. The paid Priority Pass Prestige admission is limited to the cardholder; a guest costs €30 per visit. Note also that the supplementary cardholder receives their own Priority Pass.

Explore the Priority Pass program.

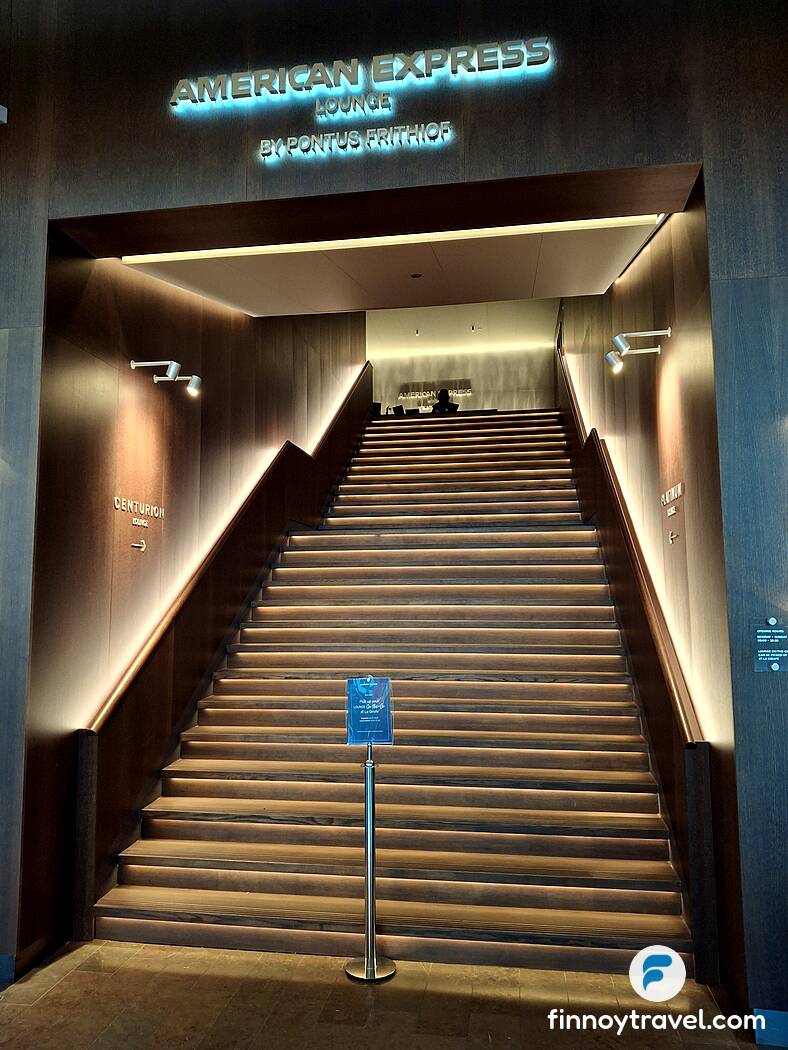

American Express also has its own lounges and direct agreements with lounge operators. Hence, an American Express Platinum member’s lounge selection is broader than that of a standard Priority Pass member. Amex lounges are typically located at major airports such as London. London Heathrow has an American Express Centurion Lounge that is very stylish. It serves hot food, and drinks can be ordered at the bar for free. The lounge is well worth a visit when travelling through London.

In addition to traditional lounge visits, Platinum cardholders can enjoy breakfast or a hot meal with drinks at the Pier Zero restaurant at Helsinki Airport. The benefit applies to both the primary and supplementary cardholders, as well as their companions. When a family travels together, up to 4 people can use the benefit simultaneously.

Read our review of the Pier Zero restaurant.

Lounge-On-The-Go

American Express offers a Lounge-On-The-Go service at several Nordic airports for travellers in a hurry. The cardholder and their companion can pick up a complimentary snack pack for the flight. At Helsinki Airport, the snack pack is provided by the downstairs section of the Pier Zero restaurant. The pack typically includes a cold and a hot drink and a time‑of‑day‑appropriate snack, such as yoghurt, a croissant, or a salad.

The Lounge-On-The-Go benefit used to be valid at the airport’s Espresso House café, but that perk has been removed. A similar benefit at the Helsinki, Turku, and Tampere railway stations also ended on 1.9.2024. Since the Pier Zero benefits at the airport exceed those of Espresso House, the impact is minor.

Lounge-On-The-Go is available in Helsinki, Stockholm, Oslo, Copenhagen, Malmö, Luleå, Gothenburg, and Visby. In Stockholm, the service is provided by the stylish La Girafe restaurant, which has an impressive American Express lounge upstairs. Amex Platinum members should also route trips through Arlanda, as the airport offers many benefits.

Because you can order a free supplementary card with American Express Platinum, the supplementary cardholder receives the same lounge benefits. Thus, with a single monthly fee, both adults in the family can enjoy lounge services with one guest each.

Explore our article on Helsinki Airport’s lounges.

Fast Track Through Security

American Express Platinum cardholders can use the Priority lane at Helsinki Airport security. The benefit also applies to a companion. For example, on a busy February morning, we saved 15 minutes thanks to this perk. At that time, we had time to enjoy the Amex‑provided breakfast at Espresso House. Unfortunately, the Espresso House benefit at Helsinki Airport has been removed, but Amex now offers a complimentary breakfast at the Pier Zero restaurant.

The benefit is also valid at Stockholm Arlanda, Gothenburg, and Malmö.

Hotel Benefits

American Express Platinum members receive elevated status in several hotel chains’ loyalty programs. In practice, this can mean better rooms subject to availability, small extras like welcome drinks, and generally higher points accrual.

The partner hotel chains are typically expensive, and budget travellers rarely stay with them. However, if you already stay at respected chains on business or leisure trips, this perk has real value.

Amex currently partners with Hilton and Radisson.

Travel Insurance

The American Express Platinum card includes travel insurance. The policy covers medical expenses, baggage, and damage to rental cars. Delays and trip interruptions are also covered. The coverage is very comprehensive.

The insurance also includes an English‑language telemedicine service.

The coverage extends to the cardholder, their spouse, children, and other cardholders. A trip may last up to 120 days. For the insurance to be valid, 75 per cent of trip expenses must be paid with the American Express Platinum card. This is stated in the terms, but it is not very prominently highlighted in the marketing materials.

Read our article about travel insurance.

Dining by Amex

American Express offers the primary cardholder and their guest a two‑course meal at a quality restaurant six times per year. The guest may choose either a starter and a main, or a main and a dessert. The partner restaurants are mainly in the Helsinki region, Turku, or Tampere, so the benefit suits those living in or frequently visiting these cities. Drinks are not included.

The benefit is available during six periods per year set by American Express. You must book a table according to the instructions. Diners must pay for extras such as drinks.

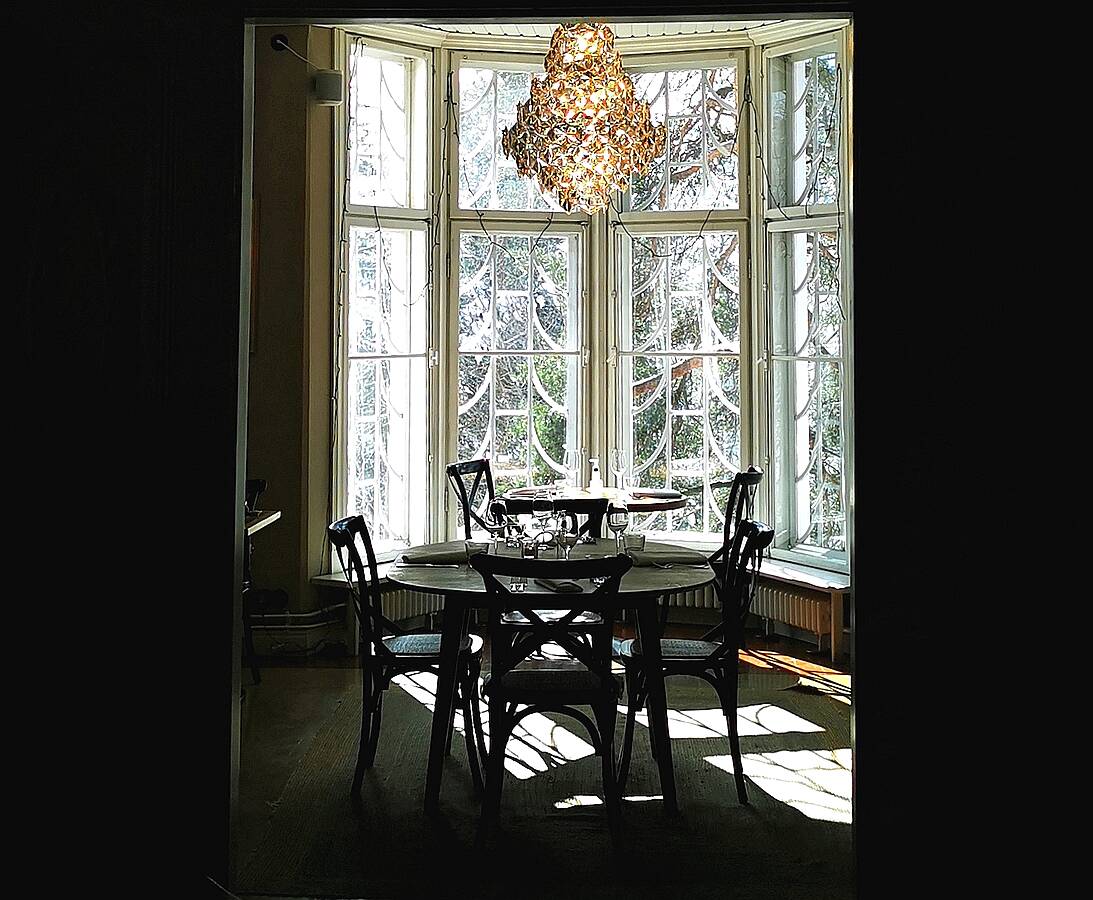

We had already used the Dining by Amex benefit several times. We visited, for example, the Villa Lilla restaurant in Espoo, located in an idyllic wooden manor in Leppävaara. The food was tasty and the service excellent. The main course and dessert were complimentary, but we paid €7 for dessert drinks and also an American Express administration fee. Today, the administration fee is no longer charged; it has been replaced with an Amex Access card that does not incur extra costs. Since we did not often dine at upscale restaurants, Dining by Amex was a pleasant perk that brought variety to everyday life.

We recommend trying the scenic restaurant Lucy in the Sky in Espoo, which is also an Amex partner.

In addition to Dining by Amex, American Express previously offered €400 in annual credits for restaurant bills—€200 for selected Amex partner restaurants in Finland and €200 abroad. This benefit has ended.

The Dining by Amex benefit was previously known as Dinner for Two.

Membership Rewards

American Express has its own rewards program: Membership Rewards. You earn 1 point per euro spent with the Platinum card. Previously, you earned 50% more. Points can be transferred to hotel or airline loyalty programs or used directly through Amex as cash toward purchases with partner services. According to Amex’s own valuation, 1,000 points are worth €3.5, which means a return of about 0.35 percent on purchases. The percentage can be much higher if you transfer points to airline programs and redeem them wisely. You can transfer points, for example, to SAS EuroBonus or Finnair Plus. Unfortunately, the transfer ratio is poor, and in the worst case, without expertise, you may even lose some value in the transfer. If your goal is to collect Finnair Avios, we recommend the Finnair Visa card.

A Platinum cardholder can get 40,000 extra points if annual spending exceeds €40,000.

Other Benefits

The card includes other smaller perks as well. Cardholders receive higher status tiers with SIXT, Avis, and Hertz. Platinum cardholders also get help planning and booking hotel stays and extra benefits at specific properties. You can skip the line at Sweden’s Avicii Arena. You can explore these benefits in detail in the Amex Experiences app..

Equivalent Benefits in the U.S.

Aside from lounge access, the American Express Platinum benefits in Finland feel modest compared to the American version. It is eye‑opening to compare the card to an American‑issued American Express Platinum.

In the U.S., the American Express Platinum annual fee at the time of comparison is only $695 (€640), so the card is cheaper than in Finland. The welcome bonus is 125,000 points. In addition, the card includes benefits not available in Finland.

For example, in the U.S., cardholders receive $200 for hotel services, $240 for entertainment services, $155 for Walmart, $200 for Uber, and $200 for airline services. On top of these, the card has numerous other perks.

Customer Service

American Express offers English‑language chat customer service via the Amex FI app. The chat is available directly in the app, and in our experience, the wait time has been short. We have not encountered Finnish‑language chat support.

You can also contact phone support via the Amex FI app, which connects a regular phone call to Amex customer service. Before you get to a real person, you must deal with an English‑language bot, which can be a bit frustrating. After that, the call connects quickly to a representative.

Customer Service Experience: Access Card Issue

In June 2025, the Access Cards in the Amex Experiences app stopped working. Instead of the cards, the app displayed a message advising to wait a few days for registration confirmation, even though registration had been completed over a year earlier. Due to the app issue, we missed two airport benefits.

We contacted chat customer service through the Amex FI app, where we were told a technical change caused the issue. We were advised to log out and back in, and that solution worked.

We asked why the actions required by the change were not communicated in advance. The agent claimed the change had been communicated by email. When we questioned this, they repeated the claim and even provided a specific date. We could not find the message in our email.

We requested a formal credit since the Access Cards’ malfunction prevented us from using the airport benefits. According to the agent, a credit could not be granted because we could have resolved the issue at the airport. Troubleshooting this kind of problem in a security queue would hardly have been straightforward.

We finally called Amex’s Finnish‑language customer service, where they were clearly more understanding about the inconvenience. They told us directly that no notice had ever been sent. Although they could not offer a credit either, they promised to escalate the matter for review.

The review took a few weeks, and Amex offered a €35 credit.

In summary, American Express’s customer service is easy to reach, but the service is not smooth in all respects. Only the Finnish‑language service and an official complaint led to tangible results. The credit amount itself was appropriate.

Who Should Get the Finnish American Express Platinum?

The American Express Platinum card is intended for those who travel frequently for work or leisure. With a supplementary card, it especially suits families who travel a lot and stay in quality hotels. Food lovers will appreciate the Dining by Amex benefit.

The card is less suitable for someone using it alone and travelling only a few times a year. In that case, the annual fee far exceeds the value of the perks.

An Alternative for Lounge Lovers

You shouldn’t apply for American Express solely for lounge access if you plan to visit lounges alone only a few times a year. There are numerous affordable ways to access lounges, which you can explore in Finnoy Travel’s lounge article. For monthly travellers, the lounge perk alone is worth at least the card’s annual fee.

Read our review of Nordea’s Platinum Credit Card

.Surcharges When Using the American Express Card

Although American Express Platinum is a premium card, it is not accepted everywhere. You absolutely need a traditional Visa or Mastercard alongside it. For example, Lidl in Finland does not accept American Express cards.

Online, the American Express card is accepted by most services. However, you quite regularly have to pay a surcharge for using the card. The surcharge is almost always higher than the value of the Membership Rewards points earned from the transaction. For that reason, it usually does not make sense to pay with American Express, as the total cost becomes higher.

Is Amex Worth the Price?

In the United States, thanks to its wider range of perks, the Platinum card would clearly be worth the price. In Finland, the card mainly benefits active travellers, while its value for others remains limited. Before applying, it is wise to estimate the annual value of the benefits and compare it with the annual fee. If the benefits do not exceed the costs, the card is not worth getting. For those who find the card too expensive, we recommend considering the Nordea Platinum card.

Our Experience With the Amex Platinum Card

We tried the American Express Platinum card a few years ago. We felt the card was expensive relative to its benefits. Having obtained the card again, it was nice to see that the number of perks had increased.

The lounge benefits are excellent, and we used them actively. Everything worked perfectly. We also explored the Dining by Amex concept, and it delivered as promised. Likewise, the food at the Pier Zero airport restaurant was tasty.

The Amex Experiences app installed on the phone is handy because it summarises all the benefits. Unfortunately, the detailed terms are often tucked away, and we would like to see those communicated clearly too. The app also features seasonal perks, which so far have consistently been ski waxing in Sweden. It is a bit odd that a premium card’s offers are so poorly targeted.

The technical implementation of the American Express concept in Finland still has shortcomings. It is not easy to find information on Amex’s website, and the translations are at times weak or even incorrect. One might expect a premium card provider to be top‑notch in every detail, but that is not the case with Amex. Customer service works, but it is a bit rigid. These small things give the impression that Finland is not a priority market for Amex.

Our Rating of the American Express Platinum Card

We rated the American Express Platinum card 4 stars. For a small target group, American Express Platinum is an excellent premium charge card with several great features. For travellers in particular, the benefits are valuable. But because the card is, in our view, slightly too expensive, we cannot give it five stars.

Questions and Answers

- How Much Does American Express Platinum Cost?

- The card costs €65 per month.

- What Are the American Express Platinum Card’s Benefits?

- The card includes numerous lounge perks for both the primary and the supplementary cardholder. Dining by Amex provides complimentary dinners. The card grants access to higher elite tiers in many hotel programs without requiring points. It also includes travel insurance, a rewards program, and other minor perks.

- What Is Priority Pass?

- The Priority Pass that comes with the American Express Platinum card entitles the cardholder and one guest to access over 1,500 airport lounges. At Helsinki Airport, there are three of these lounges. The Platinum card also grants access to other lounges.

- What Are Membership Rewards Points Worth?

- According to Amex’s own calculation, 1,000 points are worth €3.5.

- Does the Supplementary Card Cost Extra?

- The supplementary card does not cost extra.

- What Is the Income Requirement for the American Express Platinum Card?

- The income threshold has not been published, but to our knowledge it is about €20,000 per year.

Read our review of the OP Platinum Card.

Bottom Line

American Express Platinum is not worth getting for the name alone. The card is a sleek status symbol, but unfortunately, it is not accepted by all merchants in Finland and Europe due to its higher merchant fees. You should absolutely carry a standard Visa or Mastercard alongside it.

In our view, a good reason to get an American Express Platinum is its lounge and hotel benefits for the whole family. If you won’t use these enough, a better choice for a traveler may be the free Morrow Bank Mastercard, which, considering it is free, includes many good perks and, in our opinion, an even better rewards program than American Express Membership Rewards.

Only get a credit card if your finances are already in good shape and you are responsible with money. Always pay your statement in full, because carrying a balance on a credit card can be expensive.