Saldo Bank

Saldo Bank is a Lithuanian bank, with a branch in Finland. The bank is fully digital with no traditional branches. Its services include Fixed-Term Accounts, various loans, and a Visa credit card. Saldo Bank is still relatively unknown in Finland, but brand awareness is growing thanks to advertising campaigns.

Credit Card

Saldo Bank offers a Visa card, a conventional credit card. The credit and spending limit is low, up to just €2,000. For many, that amount is enough if the card is not used for big-ticket purchases. Saldo Bank offers up to 45 days of interest-free time to pay, after which any unpaid balance is added to the revolving balance. The interest on that credit is expensive, so it does not make sense to use Saldo Bank's Visa for borrowing.

A €2,000 credit limit is small for things like renting a car. In addition to the rental price, agencies typically place a large temporary deposit hold.

Visa Card Benefits

Easy To Apply

Saldo Bank is digital, so applying for the card is straightforward, and you get a decision in 15 minutes. You can check the new card number online immediately after signing the agreement electronically, and the physical card is mailed within 14 days.

Saldo Bank's website is in Finnish, and the translation quality is good.

No Annual Fee

The Saldo Bank Visa has no annual fee, so the card costs nothing to hold if the cardholder pays the bill in full by the due date.

Interest-Free Grace Period

With Saldo Bank's Visa, you get up to 45 days of interest-free payment time. Purchases do not need to be paid immediately; you can defer payment without interest until the due date. Saldo Bank sends a consolidated statement showing your transactions, total, and due date. The statement is delivered by post or email, according to the customer's choice. After the due date, Saldo Bank charges interest and a service fee on any unpaid portion of the statement.

ATM withdrawals and transfers from the card to a regular bank account start accruing interest immediately. For fee-free cash withdrawals, we recommend the Bank Norwegian Visa Card.

Transaction Tracking

Saldo Bank offers online banking where you can manage card settings and track spending. This is a standard feature of almost all credit cards. Saldo Bank's online banking is pleasant and straightforward to use.

Free Currency Conversion

Saldo Bank's Visa card has one excellent feature: currency conversion is free. That is real savings for travellers, as many banks charge up to 3 per cent for currency conversion. Saldo Bank uses Visa's wholesale rates for conversions and does not add its own markup.

Drawbacks of Saldo Bank's Visa

Limited Features

The card is among the most limited on the market in terms of features, and the maximum credit limit is small. Without free currency conversion, it would be hard to recommend this card.

Read about Cashback Credit Cards.

Expensive Credit

Saldo Bank's Visa is cost-free only if you pay your statements in full by the due date. If you carry a balance, Saldo Bank charges a 0.0 per cent daily account management fee on the outstanding balance, capped at €150 per year. On top of that, the revolving credit carries a steep interest rate of nearly 20 per cent. Do not use Saldo Bank's Visa for borrowing; there are many clearly cheaper credit cards on the market.

ATM Withdrawals Accrue Interest

Cash withdrawals from ATMs accrue interest starting on the withdrawal date. Even if there is no separate ATM fee, you start paying interest immediately on the amount withdrawn. Many banks offer fee-free ATM withdrawals, so Saldo Bank's Visa is not the right card for cash machines.

Application Process

We tested applying for the Saldo Bank Visa card. The clear application form on Saldo Bank's website asked for basic personal details plus information about income, assets, life situation, and intended card use. Toapplyn, we had to verify our identity using another bank's credentials. Saldo Bank also requested authorisation to automatically review our day-to-day bank account data to verify our income and assets. Once the required steps were completed, Saldo Bank issued an approval immediately. Finally, the card agreement had to be signed electronically.

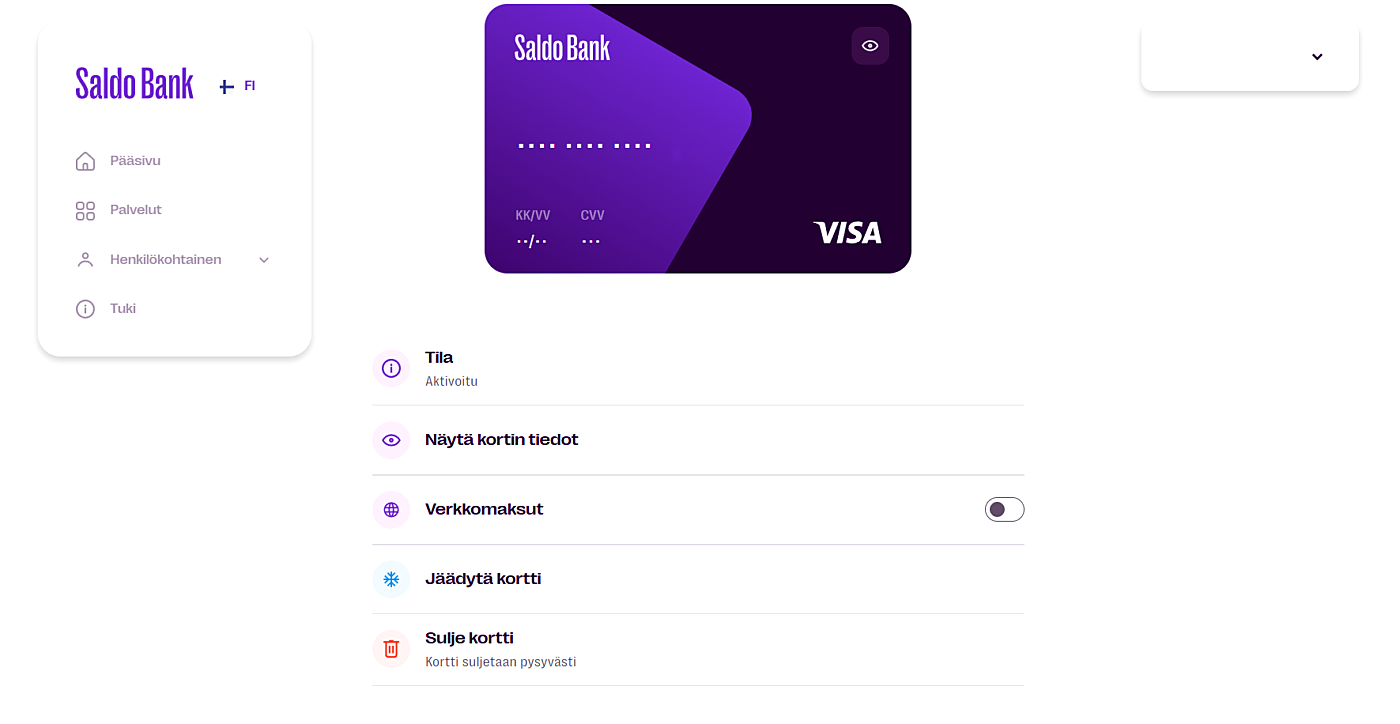

Right after approval, the card details were visible in Saldo Bank's online banking so that the card could be used for online purchases immediately. The physical card was promised to be mailed home soon. In online banking, we can monitor card transactions and transfer the card's credit to our bank account. Transferring money from the card credit is a paid add-on service. You can block the card temporarily or permanently in online banking.

Read about Credit Card Perks.

Jokerit Credit Card

In addition to the standard credit card, Saldo Bank offers a Jokerit credit card with a few extra features. Saldo Bank offers a 4-month interest-free period on Jokerit season ticket purchases made with the Jokerit card. Cardholders also receive promotional offers on fan merchandise. The card may give other Jokerit-related benefits as well.

Rating

Saldo Bank's Visa card would be only a two-star credit card if it did not offer free currency conversion. With no monthly fee and free currency conversion, it earns three stars. The card does not impress with features, though. It can be cautiously recommended as a first Traveller's Credit Card, but it is wise to explore other similar credit cards as well.

Bottom Line

Saldo Bank's Visa looks like the bank's first credit card product and has not yet been developed very far. The target audience seems to be people who do not have a credit card from their everyday bank. Free currency conversion is used to attract travellers.

You could get the card as a backup, since, when used correctly, it is cost-free. Outside the euro area, it saves money on purchases made in foreign currencies. We do not see any other specific use case for the card. On the positive side, we can also mention the easy and technically reliable application process.